About Deribit

- Low trading fees

- Wide selection of cryptocurrencies

- No forced KYC

- Well-designed exchange

- Professional team

Deribit Summary

| Headquarters | Panama |

| Found in | 2016 |

| Native Token | None |

| Listed Cryptocurrency | Bitcoin and Ethereum |

| Trading Pairs | N/A |

| Supported Fiat Currencies | USD |

| Supported Countries | Worldwide except in the USA, Canada, and Japan, and a few more countries |

| Minimum Deposit | 0.001 BTC |

| Deposit Fees | Free |

| Transaction Fees | Maker Fee - -0.01% Taker Fee - 0.05% |

| Withdrawal Fees | Depends on the Bitcoin Network |

| Application | Yes |

| Customer Support | Mail FAQ Support |

Quick Overview of Deribit

- Operating since 2016

- Global futures and trading cryptocurrency exchanges

- 50x leveraged futures for Ethereum

- Bitcoin and Ethereum leveraged trading

- 100 X leveraged futures for Bitcoin

- Very fast trade matching performance

What Is Deribit?

Deribit is a cryptocurrency derivatives exchange platform for futures and options trading. Traders can exchange BTC futures at 100x leverage and trade ETH futures at 50X leverage. Options trading for BTC also goes up to 10x leverage. But in spite of the high leverages offered, Deribit makes sure that the customer’s digital funds are kept secure with the help of cold storage wallets.

Deribit Review – Platform Interface

How Does Deribit Work?

Step 1

Deribit customers can view two trading pages- one for Bitcoin futures trading and one for Bitcoin options trading.

Step 2

Users then select the page they want and then select their order. Deribit accepts stop market orders, limit orders, and market orders.

Step 3

The orders are processed through Deribit’s fast trade matching engine. The orders pass through a risk management system and are executed as per time-price prioritization analyzed by the Deribit algorithm. Deribit does not accept any self-orders. Self-orders are immediately identified by the Deribit system with the help of the deposit address and sending address and rejected.

Step 4

The risk management engine is a very important part of the Deribit derivatives exchange. The risk engine processes thousands of orders every second. Orders approved by the risk engine are sent to the order matching system and the rest are returned to the user. The orders that are matched then go on to be executed.

Step 5

But the prices for the trades are decided by the Deribit BTC exchange which meets all market standards. The Deribit BTC index uses real-time data from Bitstamp, Coinbase, Gemini, Itbit, Bitfinex, Bittrex, Kraken, and LMAX Digital to calculate the BTC Index prices. The Deribit BTC index is updated every 4 seconds. The orders are finally executed at the price which is an average of all 450 updates of the index in the last 30 minutes before the expiration of the order.

Step 6

Deribit customers have to maintain a maintenance margin. All funds in an account are considered to determine the margin trading. If the user’s funds fall below the margin, a margin call is initiated and the user’s assets are liquidated till the margin is reached once more.

Step 7

Deribit uses a system of incremental auto-liquidation. During this auto-liquidation process, the user loses complete control of their account. The process only ends when the maintenance margin is brought back to less than 100% of the user’s equity.

Step 8

In addition to the auto-liquidation measures kept in place to prevent bankruptcy, Deribit also has an insurance fund to cover the losses suffered by bankrupt crypto derivatives trading.

Deribit Reviews – Start Trading with Deribit

Is Deribit Regulated?

Deribit is registered under the Republic of Panama, but it is not regulated by any international financial regulatory authorities. In fact, Deribit is suspected to have moved its operations from the Netherlands to Panama in order to avoid stricter AML regulations being introduced in the Netherlands. But since the 9th November 2020, it does require its customers to submit proper KYC documentation in order to create their trading account and trade through the exchange.

Deribit offers global cryptos derivative exchange services that are legal in many countries. But it is also restricted in a few countries. Deribit is not legal in the USA, Canada, or Japan. Citizens and residents of these countries cannot use Deribit.

Features of Deribit

- Perpetual, futures, and options trading is available for Bitcoin and Ethereum.

- Bitcoin options trading at 10x leverage is provided.

- Deribit also provides Bitcoin futures trading at 100x leverage and Ethereum futures trading at 50x leverage.

- Deribit’s matching and risk management engines are one of the fastest in the world with the ability to process thousands of orders every single second. The Deribit trade matching engine has a less than 1MS latency. This means that there is no market slippage in prices and orders can be settled usually at their original estimated quotes.

- Deribit also ensures customer asset safety by keeping almost 99% of all cryptocurrencies in cold storage wallets.

- Deribit users can also access professional-grade trade analysis and trading view performance charts in order to make smart, informed financial decisions.

- Deribit’s derivatives exchange is also designed to be user-friendly and simple to navigate for all traders.

- Deribit also has a mobile app for Android and iOS to make trading possible even on the go.

Deribit Review – Features of Deribit

Services Offered by Deribit

- Deribit offers traders the services of a cryptocurrency derivatives exchange for Bitcoin and Ethereum.

- All Deribit transactions are executed in BTC, but they can be settled in BTC or ETH.

- They also offer their customers an insurance fund to counteract losses from possible bankruptcy.

- But Deribit has a very strong and efficient margin maintenance system that significantly reduces the chances of bankruptcy.

- Deribit also has a very strong security service. They use multiple safety features like two-factor authentication, cold storage wallets, session timeouts to ensure that customers are never at risk of losing their assets.

- Deribit fee structure is also highly competitive when compared to the rates of other crypto coin exchange and basic industry standards.

- Deribit runs a test server to identify any glitches or bugs in their operations and make the experience more seamless for customers.

Deribit Reviews – Services Offered by Deribit

Deribit Review: Pros and Cons

| Pros | Cons |

| Perpetual swap, trading futures, and options. | Only available for Bitcoin and Ethereum. |

| 100x leveraged futures trading for BTC 50x leveraged futures trading for ETH. | Not legal in the USA, Canada, and Japan. |

| 10x leveraged options for trading for BTC. | Cumbersome KYC verification. |

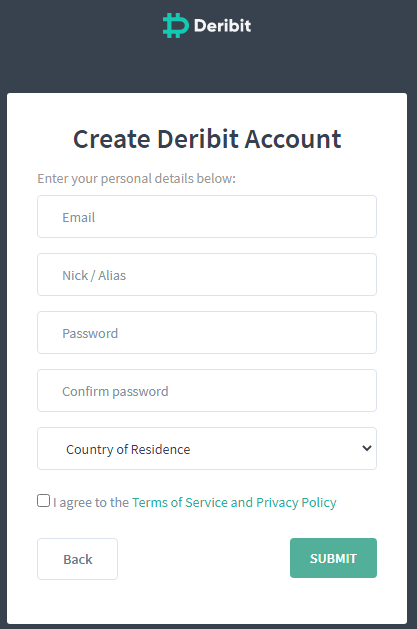

Deribit Account Creation Process

- Users first need to open an account to sign up and register for Deribit.

- They will have to put their email address, password, and country of residence in order to open their trading accounts. A confirmation email is sent to the user.

- Then there is a process of ID and KYC verification.

- Once this process is completed, users are ready to start trading.

- Users need to fund their accounts with BTC to begin placing trade orders.

Deribit Review – Sign Up Process

Buying or Selling Cryptocurrencies with Deribit

- Users can place perpetual swap orders or futures trading orders with fixed expiration dates.

- This means that users can either trade on the traditional market (perpetual swap order) or trade their asset as an option (fixed expiration futures orders).

- All transactions are done through BTC or ETH.

- The trades are settled in ETH or BTC.

- But cryptocurrency customer withdrawals from Deribit may take some time to be processed. This is because only 1% of the user’s assets are stored in hot wallets, the rest 99% of the user’s digital assets are stored in cold wallets for additional safety.

What Can You Trade at Deribit?

- Deribit lets the customers trade in Bitcoin and Ethereum options and futures and perpetual swaps.

- For each kind of trading, investors can put in three different types of orders- limit orders, stop-limit orders, and market orders. Self orders are not accepted by Deribit.

- For the futures trading with fixed expiration dates there can be weekly, monthly, or quarterly expires.

- For the options expires orders there are many varieties:-

- 1,2 daily

- 1,2,3 weekly

- 1,2,3 monthly

- 3,6, 9, 12 months for March, June, September, and December quarterly cycles.

Deribit Reviews – What Can You Trade at Deribit?

Deribit Fees

Deribit does not charge any deposit fees for the deposit of Bitcoins and Ethereum. But there is a trading fee. For all trades, there is a maker-taker fee model. This is applicable for both futures trading and options trading for both Bitcoin and Ethereum. Deribit also charges a small delivery fee for the execution of the order at the time of expiry.

There is also a liquidation fee that is charged and this charge is automatically added to the user’s insurance fund. Withdrawal fees are charged depending on the condition of the blockchain network. But withdrawals are often slow due to low hot wallet balances. The hot wallets are replenished once daily for customers who have exhausted their hot wallet assets.

Deribit Deposit and Withdrawal Method

Deribit does not charge any deposit fees at all for any deposit methods, which makes it a lucrative option for many investors. But a small withdrawal fee is charged. This fee is dependent on the congestion in the blockchain network at the time of the withdrawal initiation.

Supported Cryptocurrencies Countries

Deribit is a global cryptocurrency derivatives exchange that is legal in a large number of countries like Russia, China, England, Spain, and many more. But Deribit operations are restricted in the USA, Canada, and Japan, and a few more countries. This is because Deribit does not adhere to all international financial regulations. Deribit only supports Bitcoin and Ethereum futures and options trading and perpetual swaps.

Deribit Account Trading Platform

Deribit is a cryptocurrency derivatives exchange designed to support Bitcoin and Ethereum trades. The Deribit trading platform supports futures trading, options trading, as well as traditional perpetual swaps.

The Deribit trading platform also gives investors access to the best market analysis tools. The platform is also designed to be user-friendly and very easily accessible for users of all demographics. In fact, Deribit is also available as a mobile app to make crypto trading easier and simpler.

Deribit Futures

Deribit lets users complete futures trading for Bitcoin and Ethereum. For futures trading, stop-limit orders, limit orders, and market orders are accepted. Bitcoin futures trading on Deribit is cash-settled. That means that the user doesn’t buy or sell, send or get any Bitcoins. The order is only executed at the order expiry time at the BTC index price average of the last thirty minutes and the gains or losses are just added to the user’s account.

Deribit Leverage

Deribit allows for trading options for leveraged futures contracts. Bitcoin futures contracts can be leveraged up to 100x times, while for Ethereum it is 50x times. Leveraged trades are also available for options markets. The high liquidity of the Deribit trading platform allows for options market trading of Bitcoins at up to 10x leverage.

Deribit Mobile App

Deribit has a mobile application to make cryptocurrency trading accessible from anywhere and at any time. The Deribit mobile app is available for both iOS and for Android. The user interface is designed keeping in mind the ease of use and security concerns of users. Deribit reviews for the mobile app on online app stores are generally positive.

Deribit Mobile App

Deribit Security

- Deribit uses two-factor authentication. Users who set up two-factor authentication at login can rest assured that no one will be able to enter their Deribit account even if their account password has been compromised.

- Deribit uses a method of IP pining. This means that if the user’s IP address changes within a session, that session is terminated. This prevents hackers from gaining access to user’s accounts.

- They also use session timeouts. After a certain period of time, all sessions are automatically logged out. This provides security in case of damage or theft of the user’s device.

- They also store 99% of the user’s digital assets in cold wallets that are not on the cloud so that digital criminals cannot gain access to those assets.

Deribit Reviews – Deribit Security Measures

Deribit Customer Support

Deribit has a very efficient customer support service system. Users will first have to raise a ticket notifying customer support about their problem. The support team personnel will respond promptly and try to solve the issue as soon as possible. Deribit has a specific email address that the users can contact to raise any questions about the API or any information about possible bugs.

Deribit is very appreciative of ethical hackers. Ethical hackers who inform Deribit about any possible security breaches in their operational infrastructure are rewarded highly through the Bug Bounty program. Deribit’s customer support team is also accessible through Telegram.

Deribit Reviews – Deribit FAQ Section

Deribit Review: Conclusion

Deribit is a cryptocurrency derivatives exchange that has been in operation now for a few years. It is not yet regulated but has been deemed safe by thousands of users who utilize its services regularly. Deribit reviews are also mostly positive. The only complaints one comes across are regarding slow withdrawals and high internet speed requirements. Deribit had experienced a huge security breach and a flash crash in 2019, but since then it has been able to make a successful recovery and regain its reputation on a global level.

FAQs

Is Deribit Legit?

Deribit is not regulated by any international financial regulatory authority. But it does require KYC verification from its clients and claims to conform to AML requirements. Deribit is legal in many countries like China, Russia, England. But some countries like the USA, Canada, and Japan do not allow its operations.

Where Is Deribit Based?

Deribit was originally based in the Netherlands. But since 10th February 2020, it has shifted its base to Panama.

Can US Citizens Use Deribit?

No, US citizens are not allowed to use Deribit because it is not regulated by any internationally recognized financial regulatory authority.

How Does Deribit Leverage Work?

Leveraging lets users amplify their potential profit levels or losses for each trade. Futures trades for Bitcoin and Ethereum on Deribit can be leveraged up to 100x and 50x respectively. Options trading for Bitcoin can also be leveraged 10x.

What Are the Trading Fees Deribit Charges?

Deribit charges maker fees and taker trading fees for all transactions. The fees vary for futures trades, perpetual trades, and options trades. But the fee charged is very little and is at par with industry standards worldwide.