How to Trade at Deribit for Beginners

How to Register at Deribit

How to Register a Deribit Account on Web【PC】

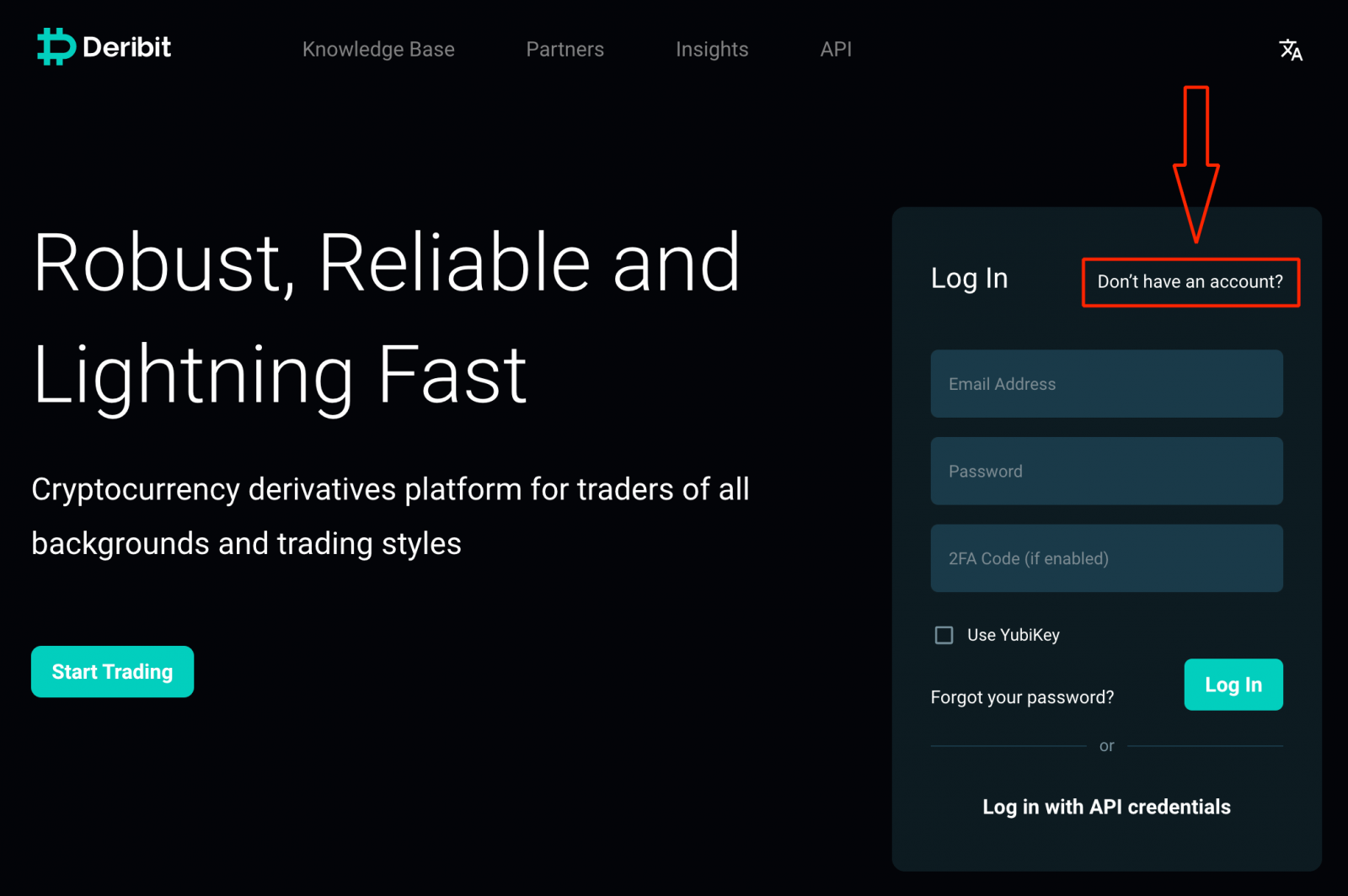

1. Visit deribit.com and click "Don’t have an account?" or go directly to the registration page: https://www.deribit.com/register

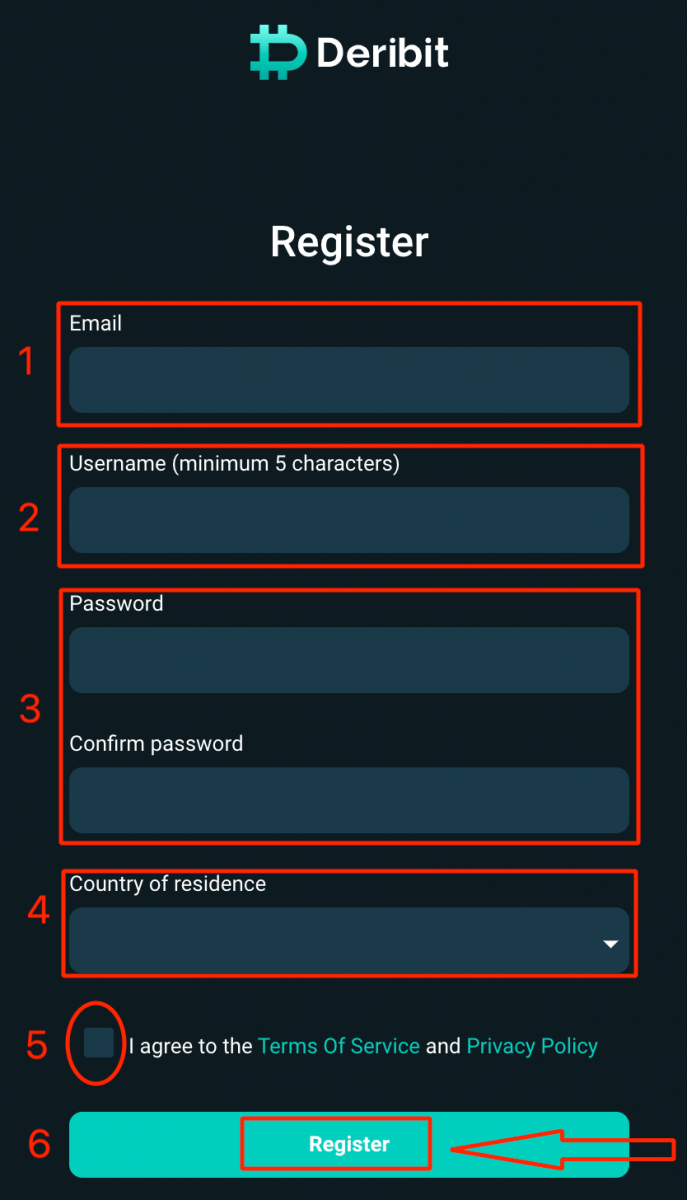

2. On the registration page, sign up using your email address:

a. Input your "Email address" , "Username" and add a strong "Password".

b. Select "Country of residence".

c. Tick the box if you have read and agreed to the Terms of Service and Privacy Policy of Deribit.

d. Then, click "Register".

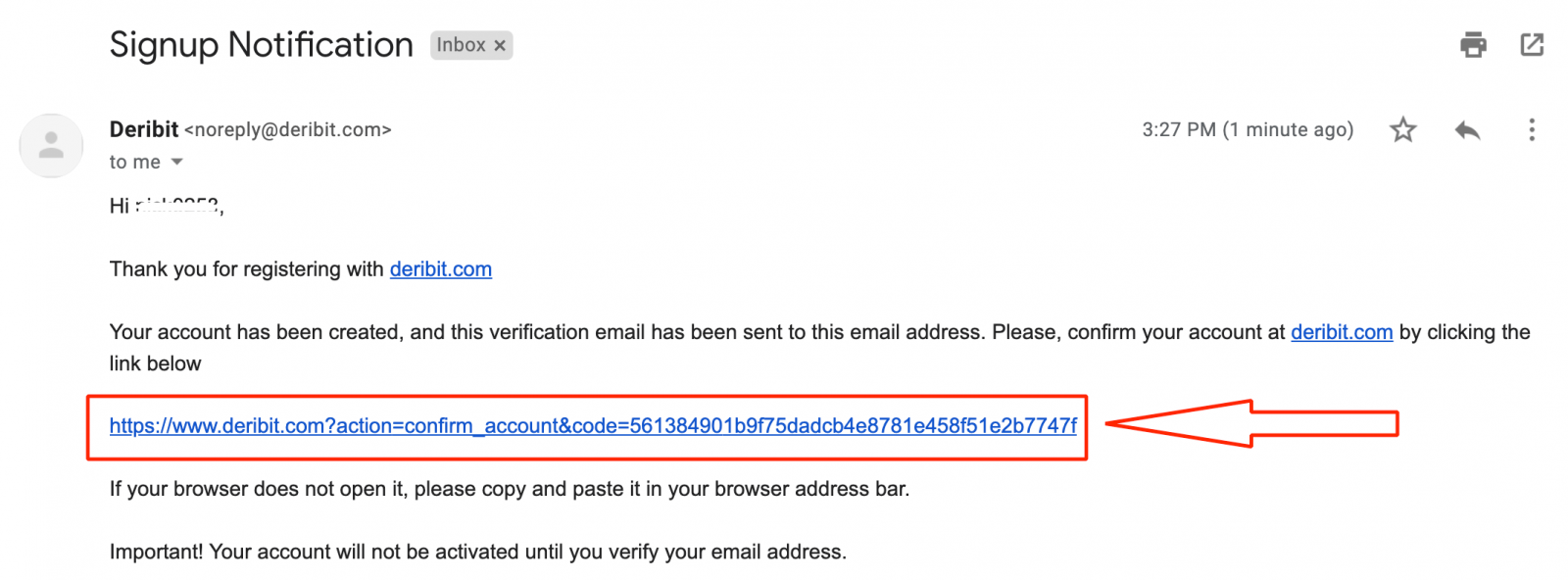

A verification email is sent to your email address. Get started by clicking the the link inside!

A Deribit account has been created successfully.

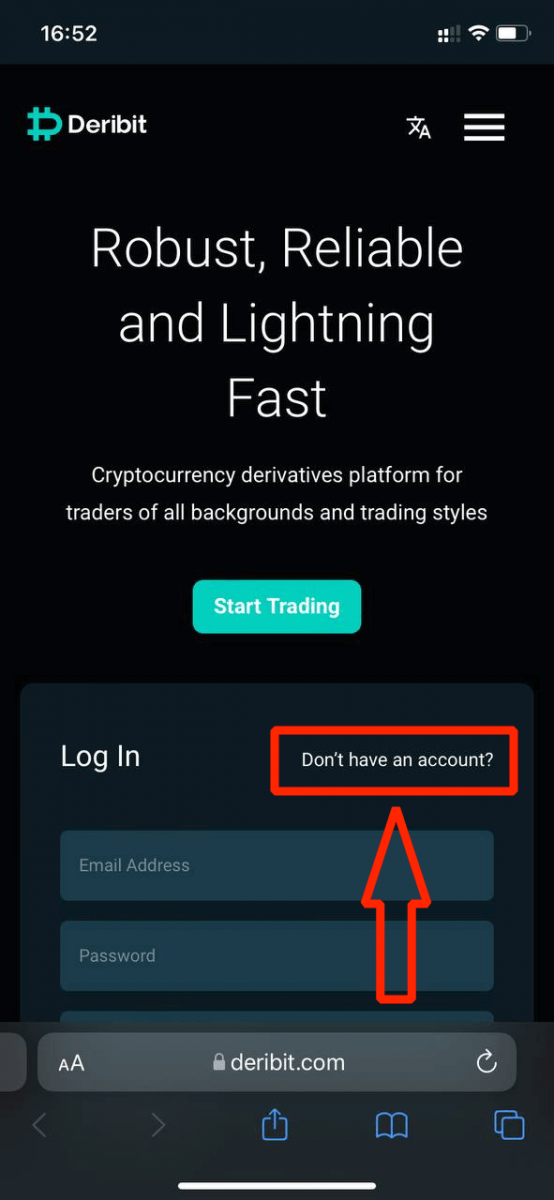

How to Register a Deribit Account on Web【Mobile】

1. Visit deribit.com and click "Don’t have an account?" or go directly to the registration page: https://www.deribit.com/register

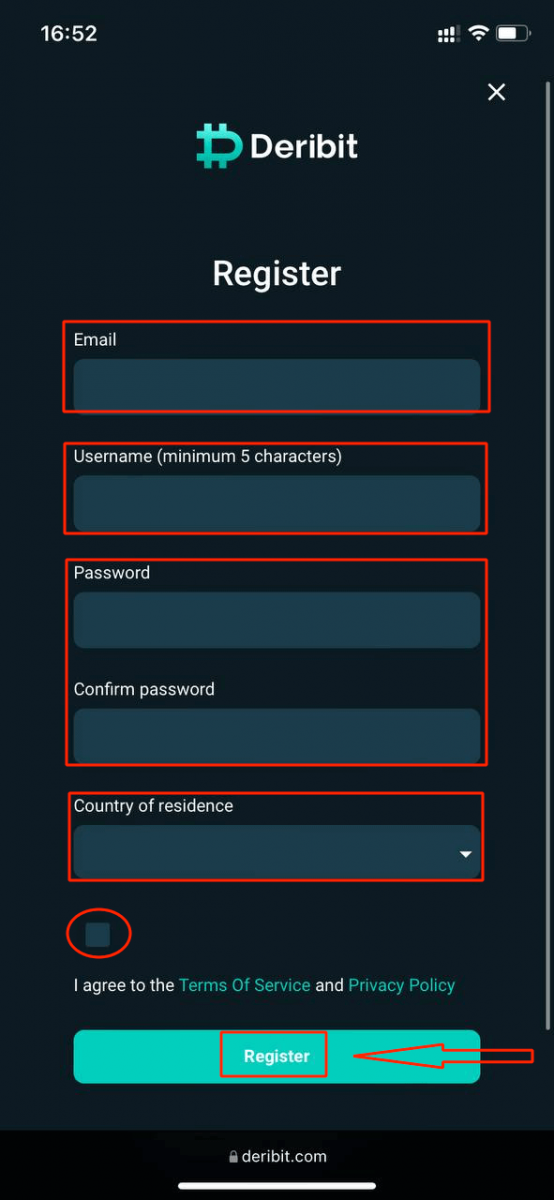

2. On the registration page, sign up using your email address:

a. Input your "Email address" , "Username" and add a strong "Password".

b. Select "Country of residence".

c. Tick the box if you have read and agreed to the Terms of Service and Privacy Policy of Deribit.

d. Then, click "Register".

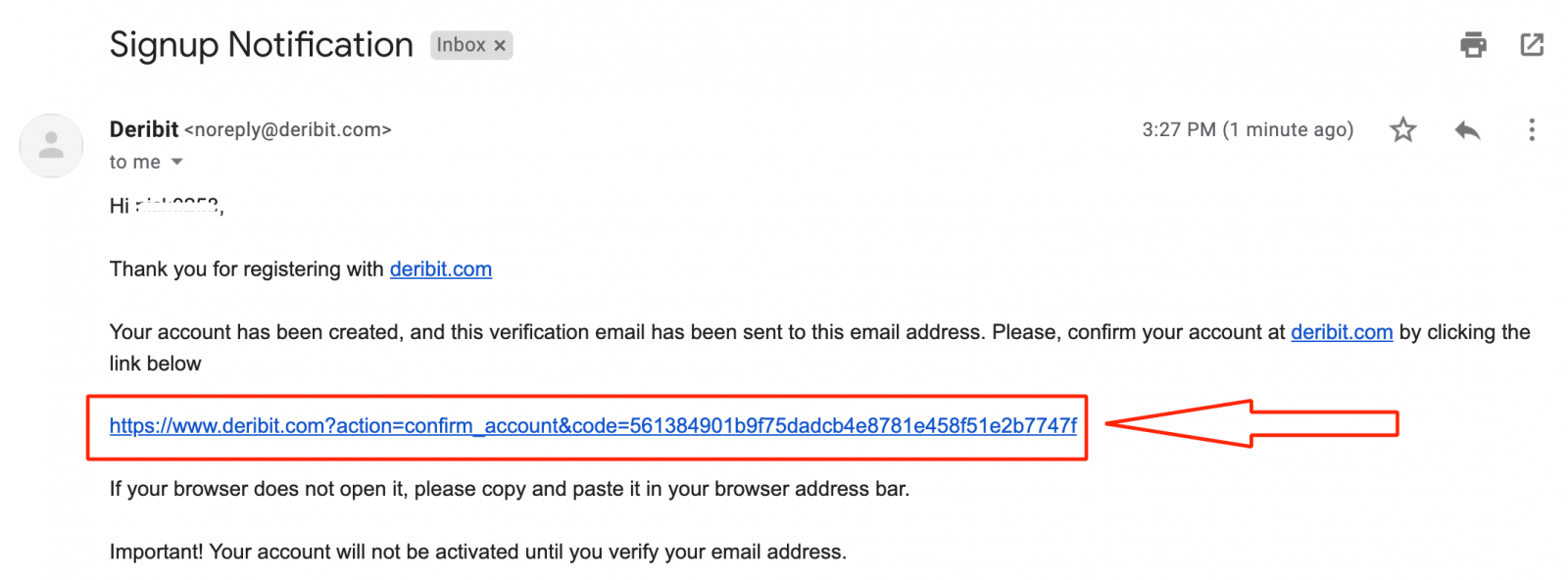

A verification email is sent to your email address. Get started by clicking the the link inside!

A Deribit account has been created successfully.

How to Download Deribit APP?

1. Visit deribit.com and you will find "Download" at the bottom left of the page, or you can visit our download page.

- The mobile app for iOS is downloadable in the iOS App store: https://itunes.apple.com/us/app/deribit/id1293674041?l=nlls=1mt=8.

- The mobile app for Android is downloable in the Google Play store: https://play.google.com/store/apps/details?id=com.deribithl=en.

Based on your mobile phone operations system, you can choose "Android Download" or "iOS Download".

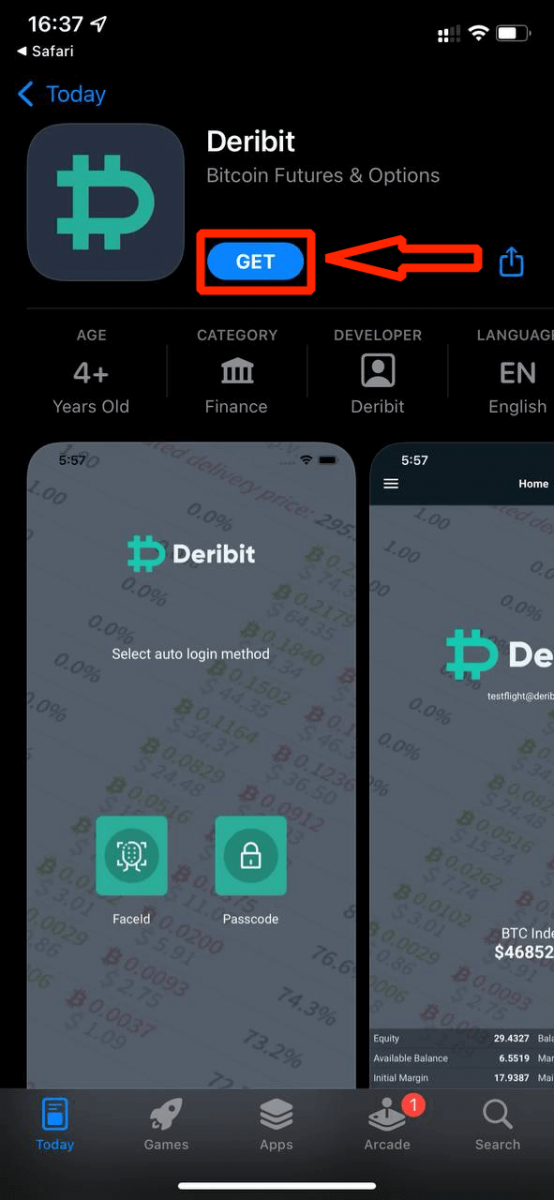

2. Press GET to download it.

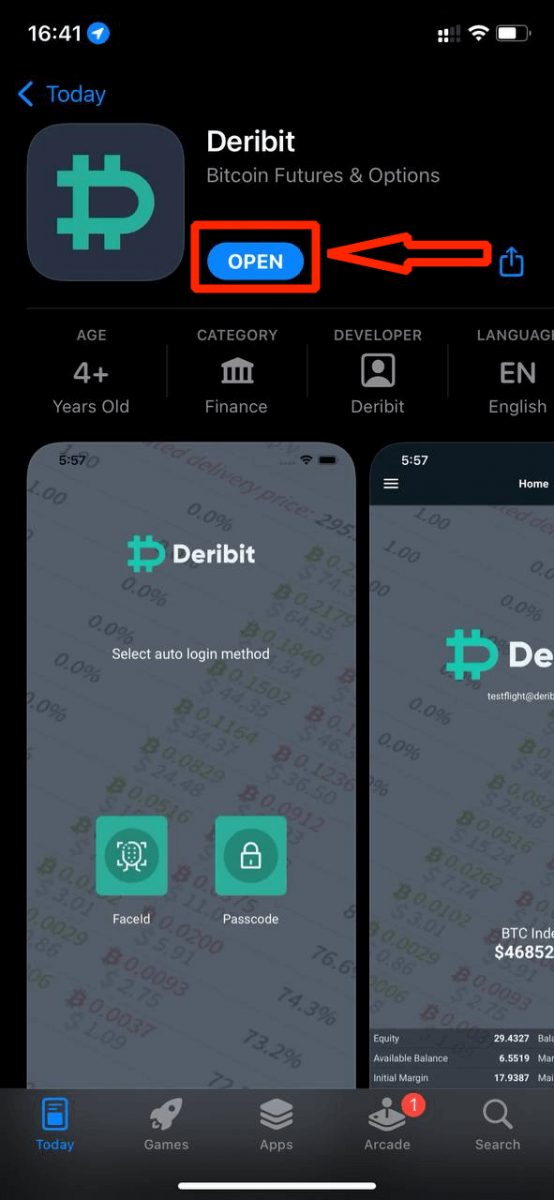

3. Press Open to open your Deribit App to get started.

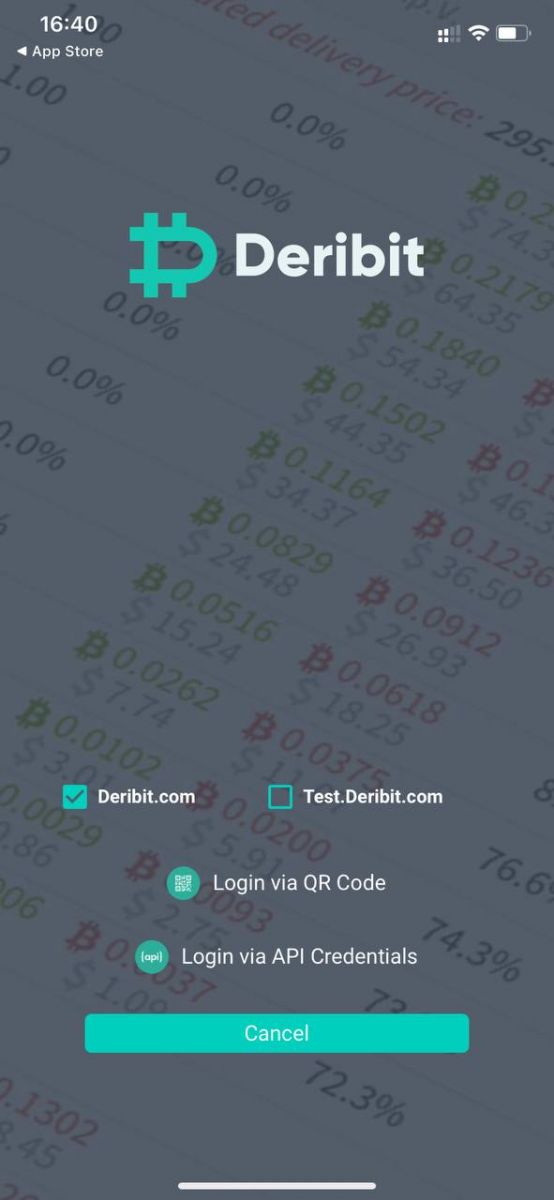

Is there a demo account functionality for newbies to try out the exchange?

Sure. You can go to https://test.deribit.com. Create a new account over there and test what you like.

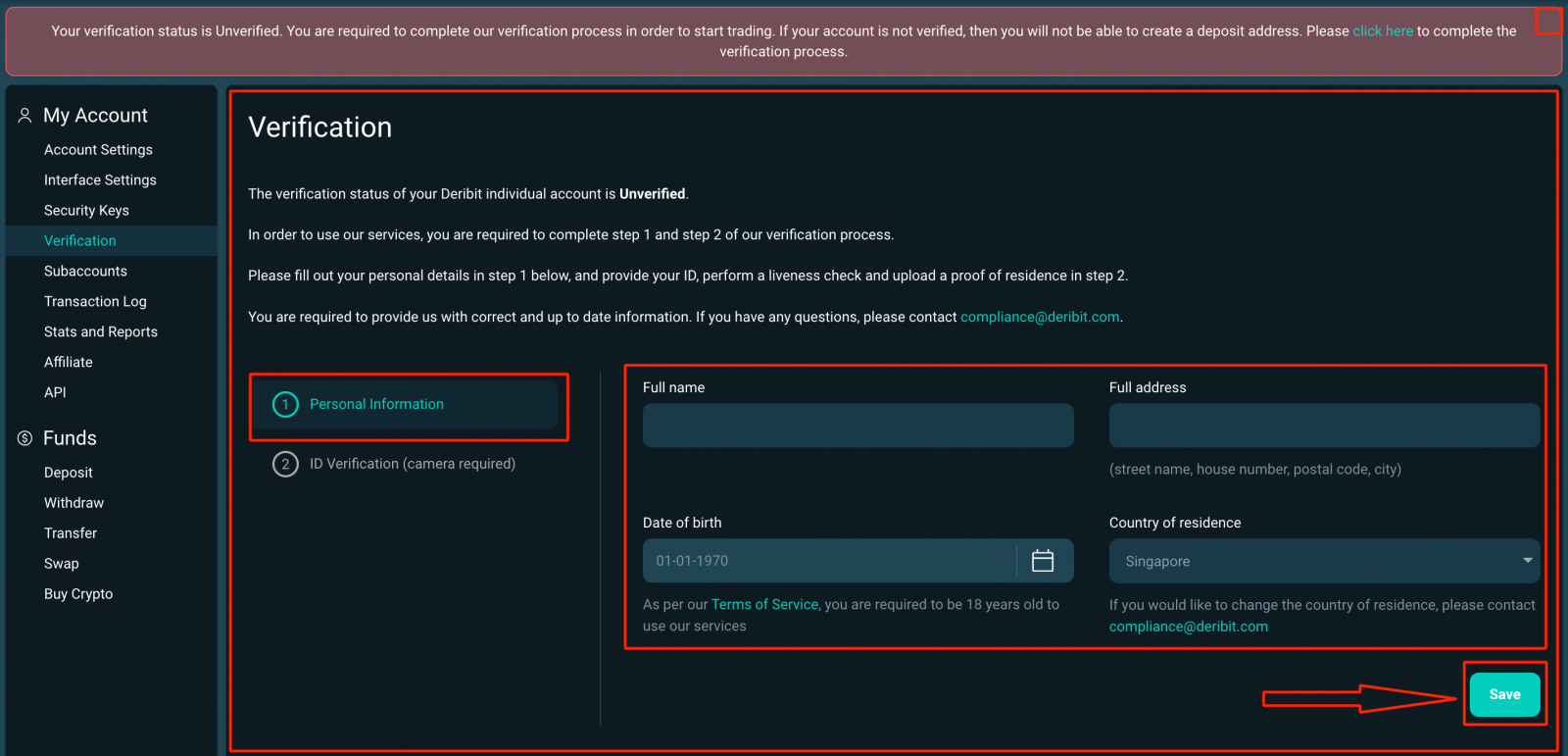

How to Verify Account at Deribit

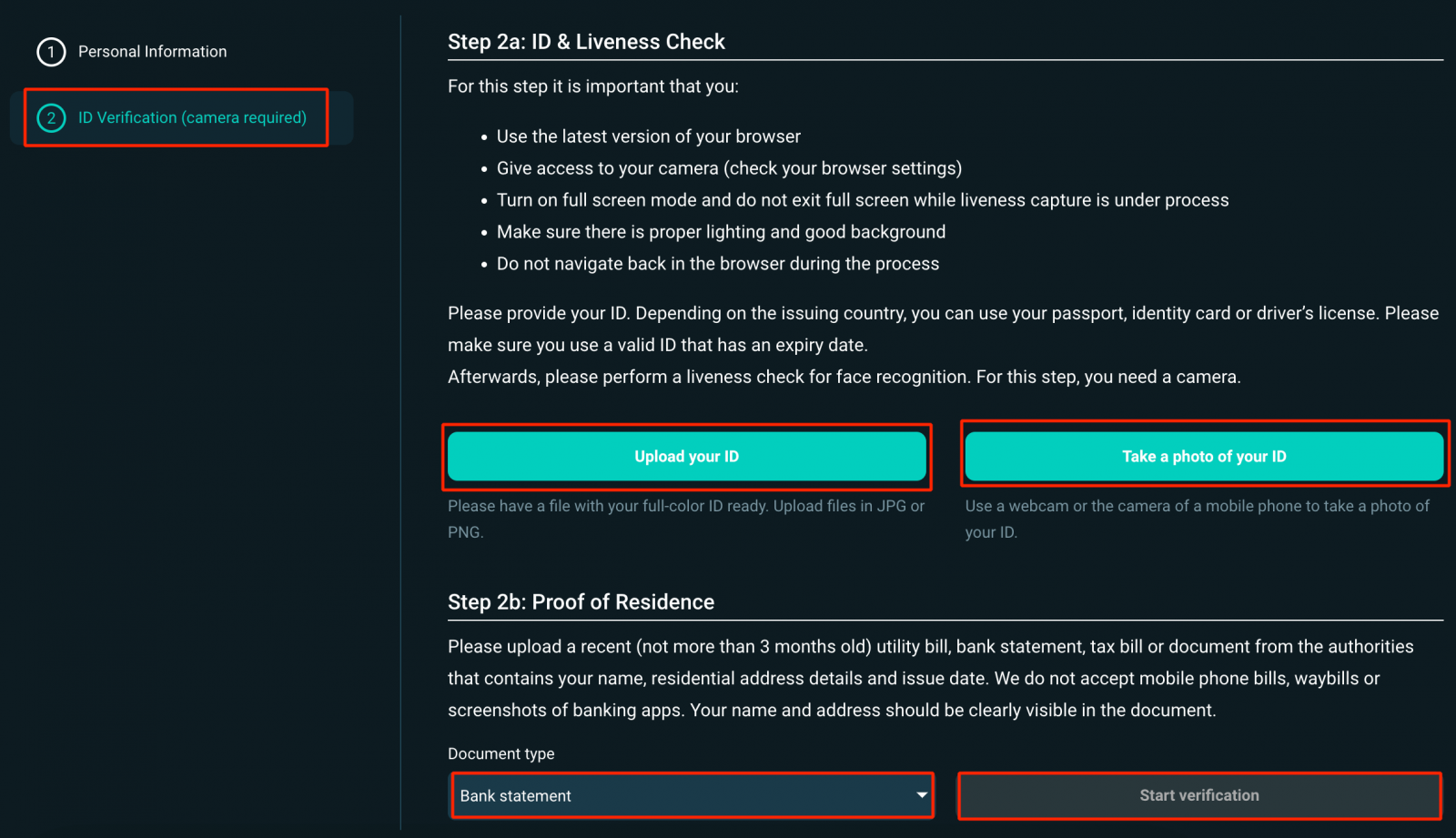

We would like to know our customers. Therefore, we ask our (potential) customers for personal details and identification documents that we will verify. Its purpose is to prevent money laundering, financing of terrorism and other illegal activities. Furthermore, these measures will protect our clients from unauthorized use of their Deribit account.Since September 2021 we have added another security measure to our KYC process. New individual (non-corporate) clients are required to complete a liveness check. This means an extra step in the verification process where a new user has to look into the camera, so our ID verification software can check if the person is the same person as the person in the ID that has been provided. This way, we minimize identity fraud.

Existing clients do not have to complete the additional step of the liveness check.

KYC requirements

Going forward, all new clients need to provide the following information:- Personal details (full name, residential address details, country of residence, date of birth)

- Identification document (passport, driver’s license, ID card)

- Liveness check (camera required) NEW

- Proof of residence (bank statement, utility bill, credit card statement, document local authorities, tax bill)

Additional information or documentation can be requested at the discretion of our Compliance team.

You can check the status of your account in the tab Verification of the menu My Account.

Deribit reserves the right to immediately close any of your accounts and liquidate any open positions if it is determined that you have provided false information about your identity or place of residence.

Corporate accounts

Please find more information on our verification process for corporate accounts here.

KYC AML Policy Summary

|

What |

How | |

|

KYC Retail |

|

The verification of documents and the liveness check is processed by Jumio. |

|

AML |

Monitoring of cryptocurrency addresses and transactions. This allows us to detect OFAC sanctioned addresses and suspicious coins from transactions related to theft, scams, hacks, darknet markets, money laundering, financing terrorism and other illegal activities. |

A Chainalysis software solution. |

|

Watchlist |

Automated screening of (potential) customers against a global database of Sanctions and Watchlists, Politically exposed persons (PEPs), and Adverse Media. |

A Comply Advantage software solution. |

|

IP address checks for account creation and logins |

If the IP address of the visitor of our website is from a Restricted Country, then it is not possible to create an account. |

IP block for account creations and continuous monitoring of the IP address used for logins to verify the origin. |

KYC Procedure

The KYC procedure is accessible in the ‘Verification’ tab in the menu My Account in your account.

When uploading your photo ID:

- Ensure that your document is valid and not expired, without hole punches or other modifications

- Ensure your document is in a well-lit area without glare. Natural sunlight is best

- Photograph the entire document and avoid cutting off any corners or sides

- Ensure the ID is fully visible and in focus

- Use the Chrome browser to complete the verification

- Try using your mobile device. In some instances, you can use the mobile app to complete the ID verification step using your phones camera

- Make sure the app or program you use to take the pictures does not add any logos or watermarks

- Do not obfuscate any information on the ID

Sharing of client information with third parties

- For the verification of ID and proof of residence documents, we have implemented the software of Jumio. Jumio has achieved certifications against PCI DSS and ISO/IEC 27001:2013 securing the data of their customers and is committed to continuous risk management.

- We also work with Chainalysis for the monitoring of cryptocurrency addresses and transactions (KYT or Know Your Transaction). This allows us to detect OFAC legal activities. ID documents and proof of residence documents are not shared with Chainalysis.

- Besides properly validated law enforcement sanctioned addresses and suspicious coins from transactions related to theft, scams, hacks, darknet markets, money laundering, financing terrorism, and other illegal activities, Deribit does not proactively share data with government agencies.

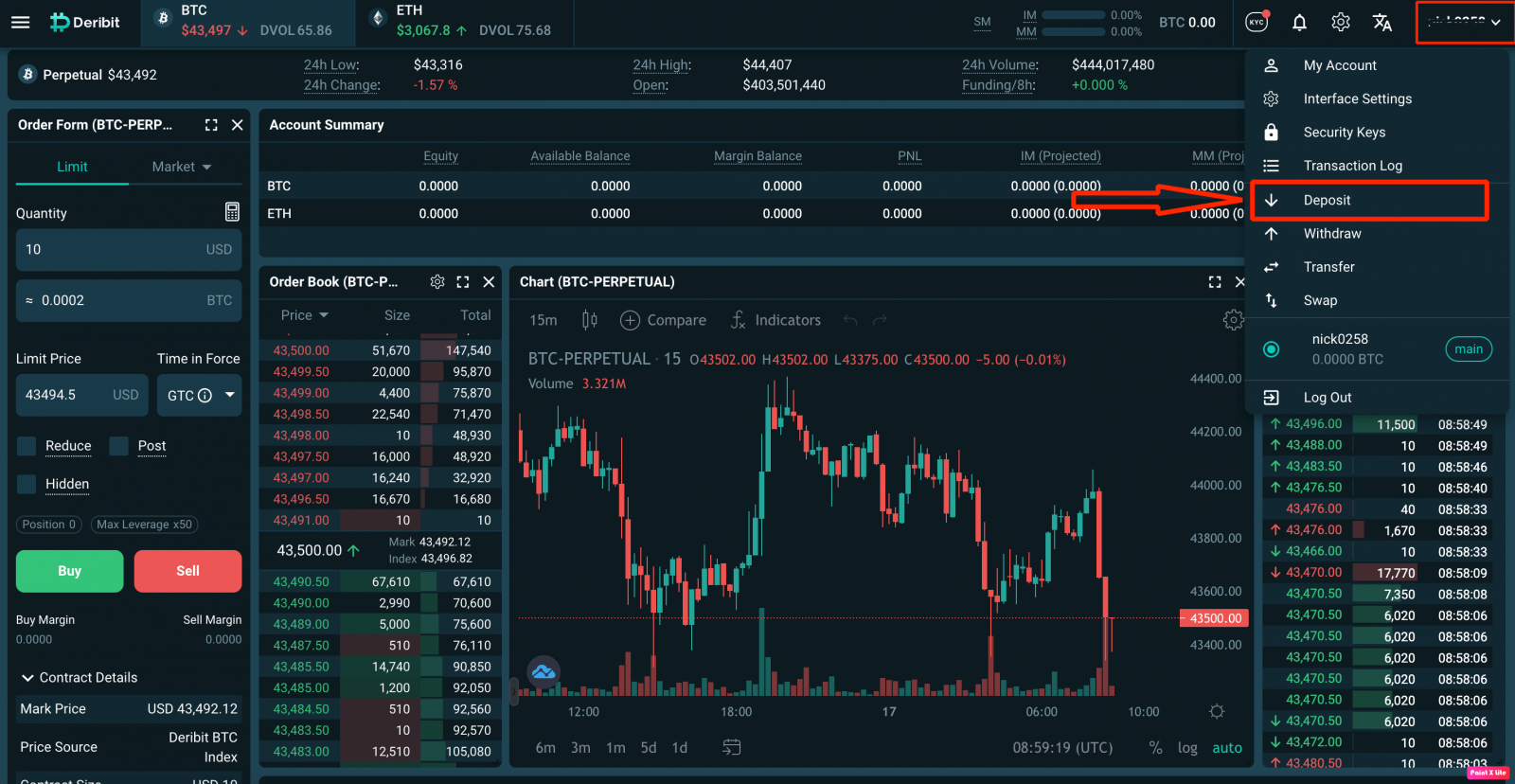

How to Deposit at Deribit

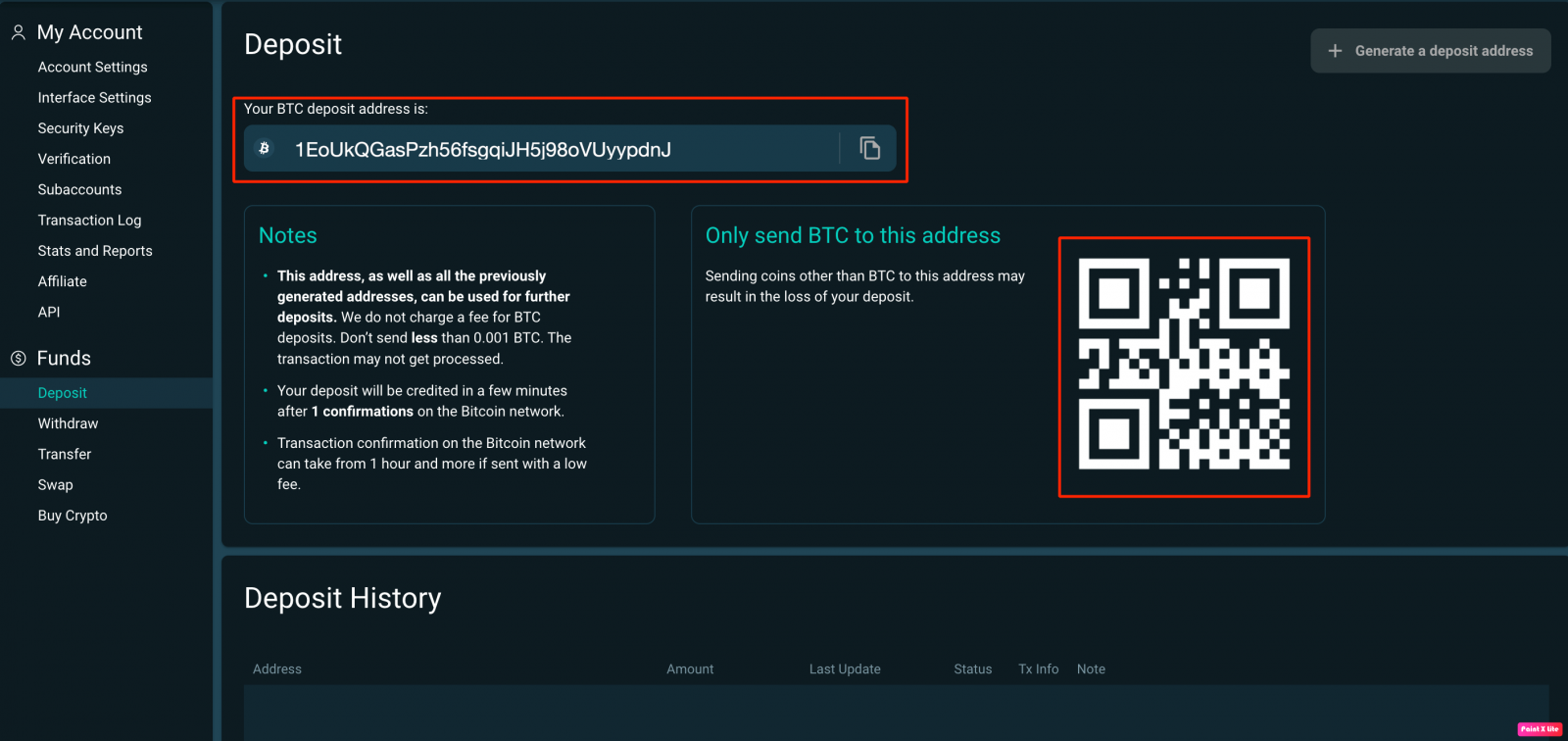

How to Deposit Bitcoin

Select the “Deposit” tab under “Account” after login.

Copy the deposit address and paste into the platform which you want to withdraw from, or you can scan the QR code to complete the deposit.

This address, as well as all the previously generated addresses, can be used for further deposits. We do not charge a fee for BTC deposits. Don’t send less than 0.001 BTC. The transaction may not get processed.

Your deposit will be credited in a few minutes after 1 confirmations on the Bitcoin network.

Transaction confirmation on the Bitcoin network can take from 1 hour and more if sent with a low fee.

Can I deposit fiat currency like USD, EUR or Rupees etc?

No, we only accept bitcoin (BTC) as funds to deposit. When we are able to accept fiat money, it will be announced additionally. To deposit funds go to menu Account Deposit where your BTC deposit address can be found. BTC can be bought on other exchanges like: Kraken.com, Bitstamp.net etc.

Are my funds safe?

We keep more than 99% of our customer deposits in cold storage. Vast majority of funds are stored vaults with multiple bank safes.

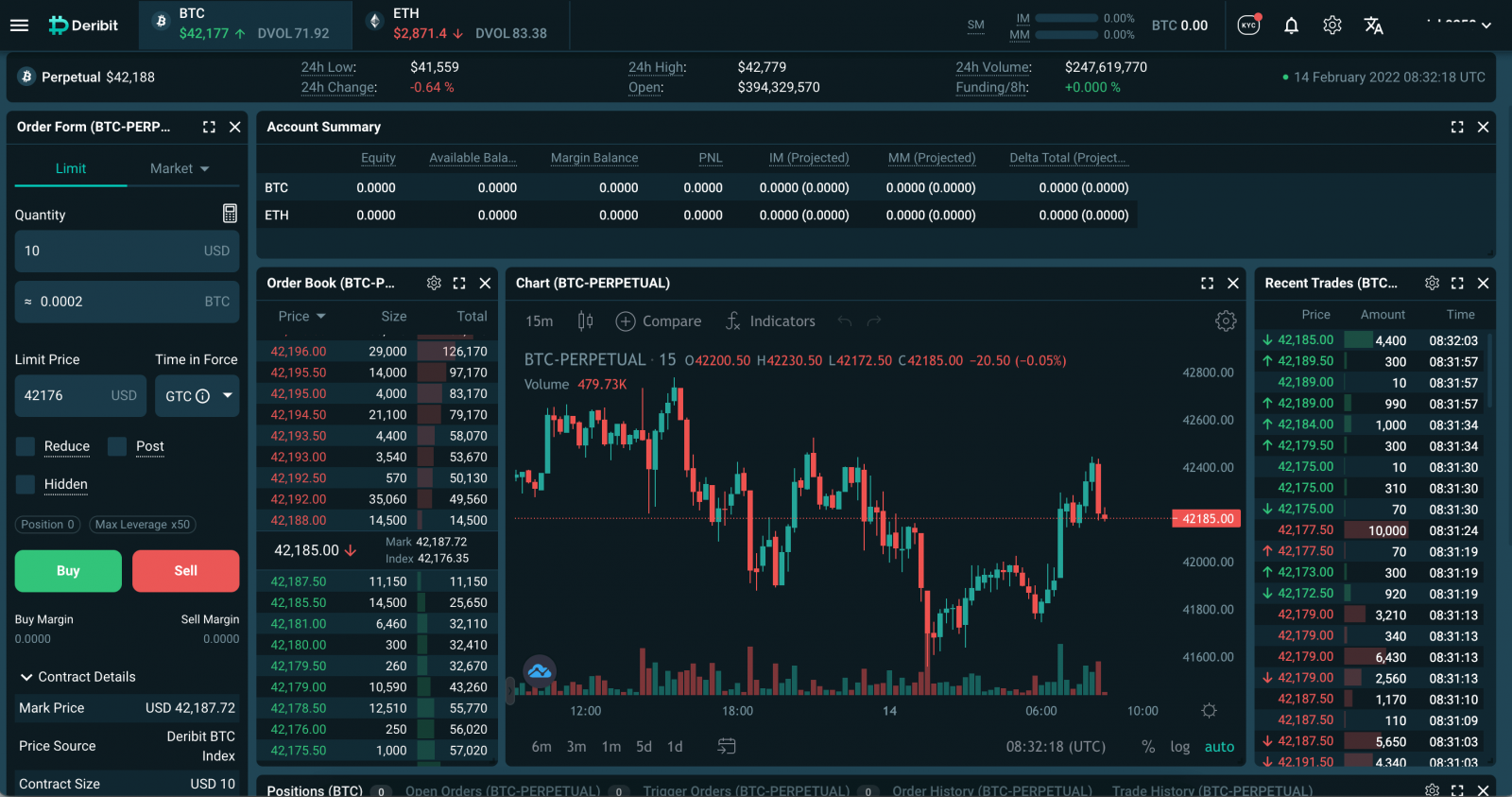

How to Trade Crypto at Deribit

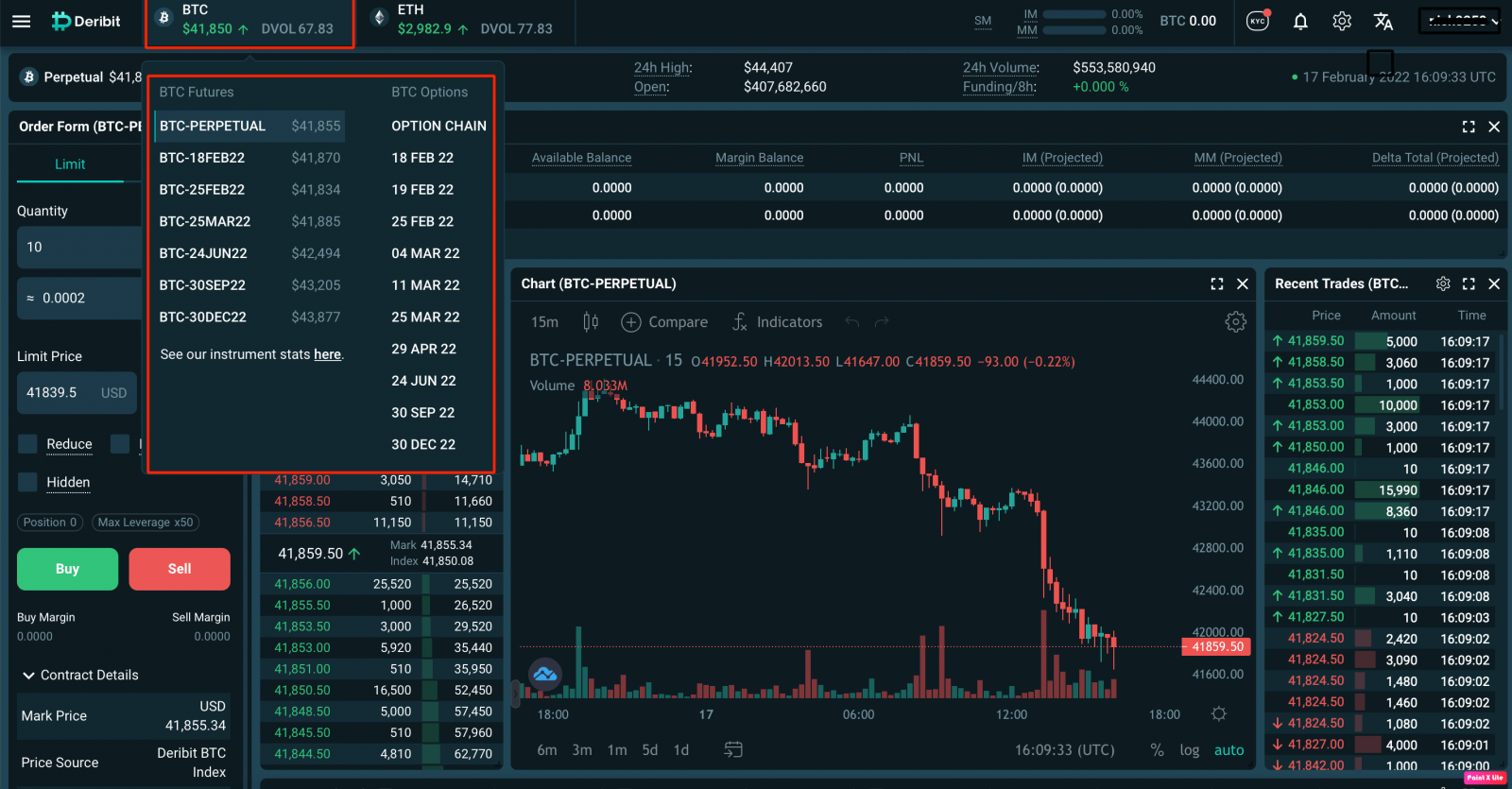

Futures

Bitcoin Futures on Deribit are cash settled rather than settled by physical delivery of BTC. This means that at the settlement, the buyer of BTC Futures will not buy the actual BTC, nor the seller will sell BTC. There will only be a transfer of losses/gains at the settlement of the contract, based on the expiration price (calculated as the last 30 minute average of the BTC price index).

Contract Specifications BTC

| Underlying Asset/Ticker | Deribit BTC Index |

| Contract | 1 USD per Index Point, with contract size USD 10 |

| Trading Hours | 24/7 |

| Minimum Tick Size | 0.50 USD |

| Settlement | Settlements take place every day at 8:00 UTC. Realized and unrealized session profits (profits made between settlements) are always added in real-time to the equity. However, they are only available for withdrawal after the daily settlement. At the settlement, session profits/losses will be booked to the BTC cash balance. |

| Expiration Dates | Expirations always take place at 08:00 UTC, on the last Friday of the month. |

| Contract Size | 10 USD |

| Mark Price | The mark price is the price at which the futures contract will be valued during trading hours. This can (temporarily) vary from the actual futures market price in order to protect market participants against manipulative trading. Mark Price = Index price + 30 seconds EMA of (Futures Market Price - Index Price). The market price is the last traded futures price if it falls between the current best bid and the best ask. Otherwise, if the last traded price is lower then the best bid, the market price will be the best bid. If the last traded price is higher than the best ask, the market price will be the best ask. |

| Delivery/Expiration | Friday, 08:00 UTC. |

| Delivery price | Time-weighted average of Deribit BTC index, as measured between 07:30 and 08:00 UTC. |

| Delivery Method | Cash settlement in BTC. |

| Fees |

Check this page for Deribit fees. |

| Position Limit | The maximum allowed position is 1,000,000 contracts (USD 10,000,000). Portfolio margin users are excluded from this limit and can build up larger positions. On request, the position limit could be increased based on an account evaluation. |

| Initial Margin | The initial margin starts with 1.0% (100x leverage trading) and linearly increases by 0.5% per 100 BTC increase in position size. Initial margin = 1% + (Position Size in BTC) * 0.005% |

| Maintenance Margin | The maintenance margin starts with 0.525% and linearly increases by 0.5% per 100 BTC increase in position size. When the account margin balance is lower than the maintenance margin, positions in the account will be incrementally reduced to keep the maintenance margin lower than the equity in the account. Maintenance margin requirements can be changed without prior notice if market circumstances demand such action. Maintenance Margin= 0.525% + (PositionSize in BTC) * 0.005% |

| Block Trade | Minimum USD 200,000 |

Contract Specifications ETH

| Underlying Asset/Ticker | Deribit ETH Index |

| Contract | 1 USD per Index Point, with contract size USD 1 |

| Trading Hours | 24/7 |

| Minimum Tick Size | 0.05 USD |

| Settlement | Settlements take place every day at 8:00 UTC. Realized and unrealized session profits (profits made between settlements) are always added in real-time to the equity, however, they are only available for withdrawal after the daily settlement. At the settlement, session profits/losses will be booked to the ETH cash balance. |

| Expiration Dates | Expirations always take place at 08:00 UTC, on the last Friday of the month. |

| Contract Size | 1 USD |

| Initial Margin | The initial margin starts with 2.0% (50x leverage trading) and linearly increases by 1.0% per 5,000 ETH increase in position size. Initial margin = 2% + (Position Size in ETH) * 0.0002% |

| Maintenance Margin | The maintenance margin starts with 1.0 % and linearly increases by 1.0% per 5,000 ETH increase in position size. |

| Mark Price | The mark price is the price at which the futures contract will be valued during trading hours. This can (temporarily) vary from the actual futures market price in order to protect market participants against manipulative trading. Mark Price = Index price + 30 seconds EMA of (Futures Market Price - Index Price) The market price is the last traded futures price if it falls between the current best bid and the best ask. Otherwise, if the last traded price is lower then the best bid, the market price will be the best bid. If the last traded price is higher than the best ask, the market price will be the best ask. |

| Delivery/Expiration | Friday, 08:00 UTC. |

| Delivery price | Time-weighted average of Deribit ETH index as measured between 07:30 and 08:00 UTC. |

| Delivery Method | Cash settlement in ETH. |

| Fees |

Check this page for Deribit fees. |

| Position Limit | The maximum allowed position is 5,000,000 contracts (USD 5,000,000). Portfolio margin users are excluded from this limit and can build up larger positions. On request, the position limit could be increased based on an account evaluation. |

| Block Trade | Minimum USD 100,000 |

Examples of Initial Margin:

| BTC Position size | Maintenance Margin | Margin in BTC |

| 0 | 1% + 0 = 1% | 0 |

| 25 | 1% + 25/100 * 0.5% = 1.125% | 0.28125 |

| 350 | 1% + 350/100 * 0.5% = 2.75% | 9.625 |

Examples of Maintenance Margin:

| BTC Position size | Maintenance Margin | Margin in BTC |

| 0 | 0.525% | 0 |

| 25 | 0.525% + 25 * 0.005% = 0.65% | 0.1625 |

| 350 | 0.525% + 350 * 0.005% = 2.275% | 7.9625 |

Example:

To better understand how futures contracts work on Deribit, below is an example:

A trader buys 100 futures contracts (size of one futures contract is 10 USD), at 10,000 USD per BTC. The trader is now long (buys) 1,000 USD worth of BTC with a price of 10,000 USD (100 contracts x 10 USD = 1,000 USD).

- Lets assume that the trader wants to close this position and sell these contracts at the price of 12,000 USD. In this scenario, the trader agreed to buy 1,000 USD worth of bitcoins at 10,000 USD, and later sold 1,000 USD worth of BTC for 12,000 USD/BTC.

- The traders profit is 1,000/10,000 – 1,000/12,000 = 0.01666 BTC or 200 USD, with BTC priced at 12,000 USD.

- If both orders were taker orders, the total fee paid on this round would be 2 * 0.075% of 1,000 USD = 1.5 USD (debited in BTC, so 0.75/10,000 BTC + 0.75/12,000 BTC = 0.000075 + 0.0000625 = 0.0001375 BTC)

- The margin required to purchase 1,000 USD worth of BTC contracts is 10 USD (1% of 1,000 USD) and thus equals 10/10,000 BTC= 0.001 BTC. Margin requirements increase as a percentage of the position, with a rate of 0.5% per 100 BTC.

Mark Price

When calculating unrealized profits and losses of futures contracts, not always the last traded price of the future is used.

To calculate the mark price, first, we must calculate the 30 second EMA (exponential moving average) of the difference between the last traded price (or the best bid/ask when the last traded price falls outside the current best bid/ask spread) and the Deribit Index.

- The mark price is calculated as:

- Further, there is a limit of how fast the spread between the Deribit BTC Index and the last traded future price can change:

The trading range is limited by a bandwidth of 3% around the 2 minute EMA of the mark price and index price difference (+/-1.5%).

The mark price bandwidth is displayed in the futures order form showing the current minimum and maximum allowed trading price (above the price field).

The mark price can never differ by more than a certain % from the Deribit Index. By default, the percentage that the mark price is allowed to trade away from the index is 10% for BTC and 10.5% for ETH. If the market requires trading with higher discount or premium (for example, in volatile periods or periods of ever-increasing contango or backwardation), the bandwidth can be increased.

Allowed Trading Bandwidth

The trading range is bound by 2 parameters:

Deribit Index + 1 minute EMA (Fair Price - Index) +/- 1.5% and a fixed bandwidth around the Deribit Index +/- 10.0%.

If market circumstances require so, bandwidth parameters could be adjusted at the sole discretion of Deribit.

Limit orders beyond the bandwidth will be adjusted to the maximum possible buy price or minimum possible sell price. Market orders will be adjusted to limit orders with the minimum or maximum price allowed at that moment.

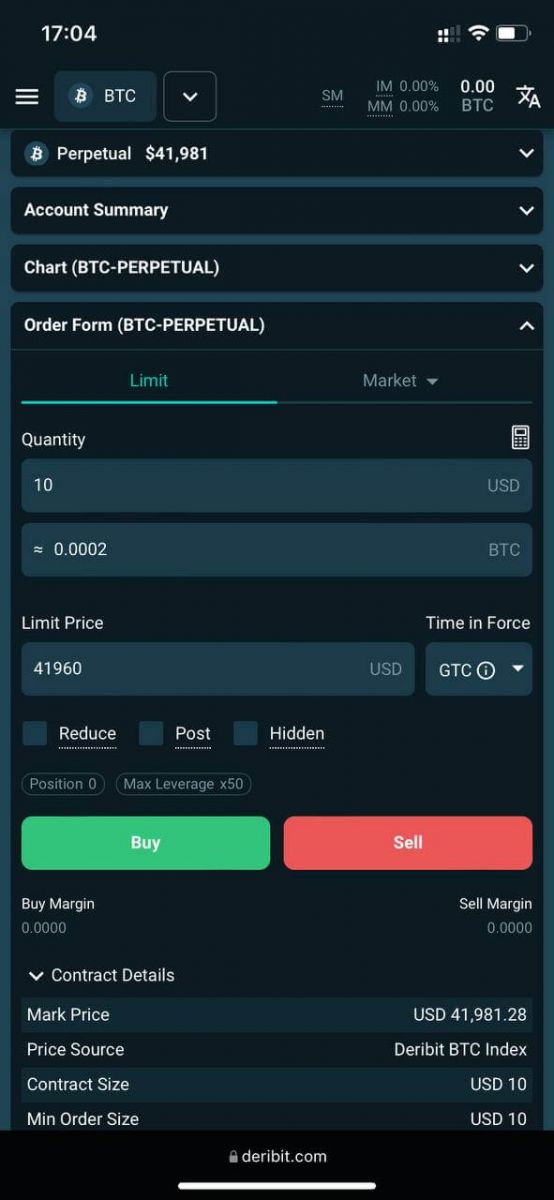

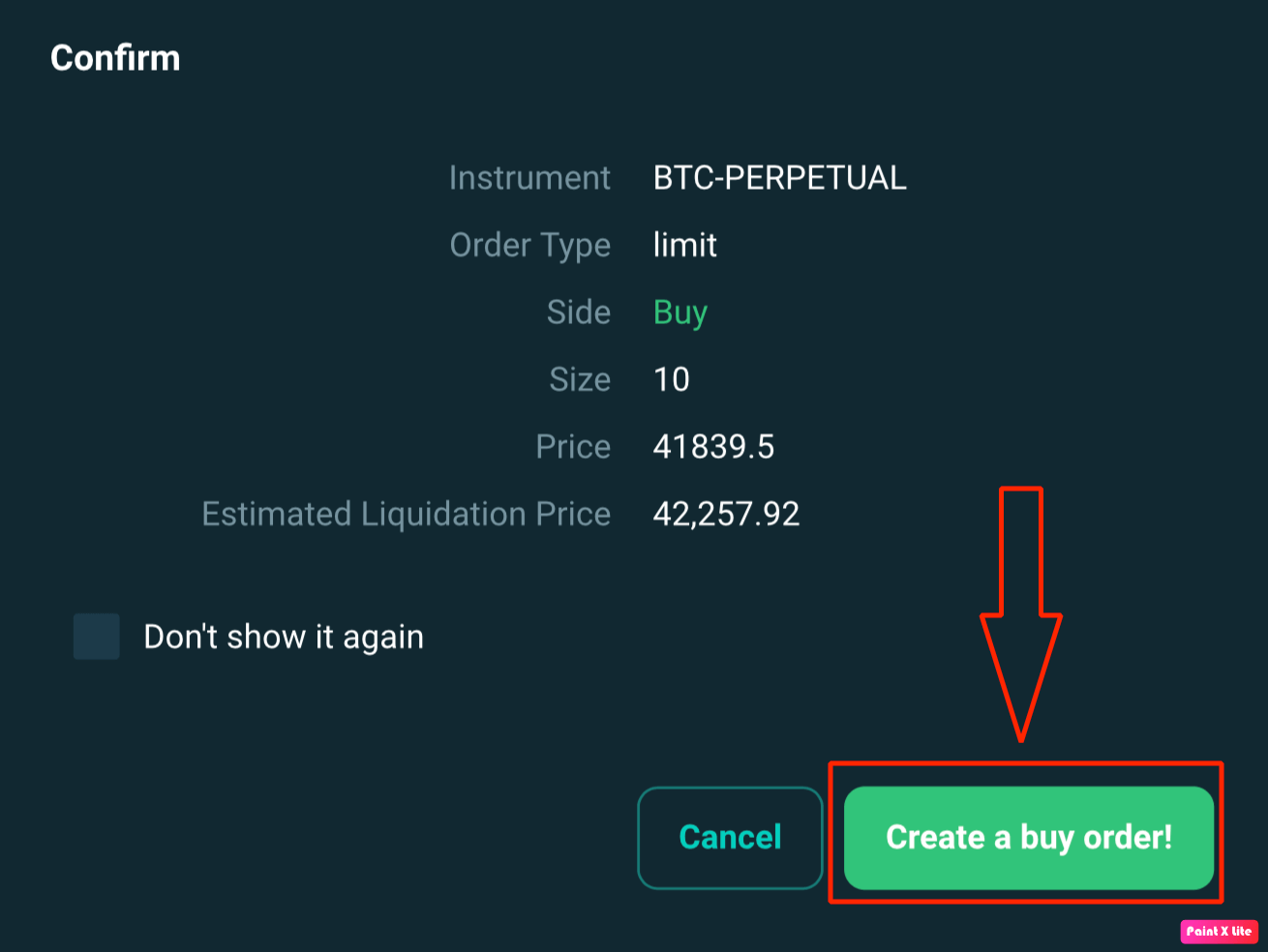

Perpetual

The Deribit Perpetual is a derivative product similar to a future, however, without an expiry date. The perpetual contract features funding payments. These payments have been introduced to keep the perpetual contract price as close as possible to the underlying crypto price - the Deribit BTC Index. If the perpetual contract trades at a higher price than the index, traders that have long positions need to make funding payments to the traders having short positions. This will make the product less attractive to the long position holders and more attractive to the short position holders. This subsequentially will cause a perpetual price to trade in line with the price of the index. If the perpetual trades at a price lower than the index, the short position holders will have to pay the long position holders.

The Deribit perpetual contract features a continuous measurement of the difference between the mark price of the contract and the Deribit BTC Index. The percentage difference between these two price levels is the basis for the 8-hourly funding rate that is applied to all outstanding perpetual contracts.

Funding payments are calculated every millisecond. The funding payments will be added to or subtracted from the realized PNL account, which is also part of the available trading balance. At the daily settlement, the realized PNL will be moved to or from the cash balance, from which withdrawals can be made.

The total funding paid will show up in the transaction history in the "funding" column. This column shows the funding amount that is applied to the traders entire net position in the period between the relevant trade and the trade before that. Put differently: the trader can see the funding paid or received on the position between position changes.

Contract Specifications BTC

| Underlying Asset/Ticker | Deribit BTC Index |

| Contract | 1 USD per Index Point, with contract size USD 10 |

| Trading Hours | 24/7 |

| Minimum Tick Size | 0.50 USD |

| Settlement | Settlements take place every day at 8:00 UTC. Realized and unrealized session profits (profits made between settlements) are always added in real-time to the equity. However, they are only available for withdrawal after the daily settlement. At the settlement, session profits/losses will be booked to the BTC cash balance. |

| Contract Size | 10 USD |

| Initial Margin | The initial margin starts with 1.0% (100x leverage trading) and linearly increases by 0.5% per 100 BTC increase in the position size. Initial margin = 1% + (Position Size in BTC) * 0.005% |

| Maintenance Margin | The maintenance margin starts with 0.525% and linearly increases by 0.5% per 100 BTC increase in the position size. When the accounts margin balance is lower than the maintenance margin, positions in the account will be incrementally reduced in order to keep the maintenance margin lower than the equity in the account. Maintenance margin requirements can be changed without prior notice if market circumstances demand such action. Maintenance Margin= 0.525% + (Position Size in BTC) * 0.005% |

| Mark Price | The mark price is the price at which the perpetual contract will be valued during the trading hours. This can (temporarily) vary from the actual perpetual market price in order to protect market participants against manipulative trading. Mark Price = Index price + 30 seconds EMA of (Perpetual Market Price - Index Price) Where market price is the last traded futures price if it falls between the current best bid and best ask. Otherwise, the market price will be the best bid. If the last traded price is lower than the best bid, or market price will be the best ask, if the last traded price is higher than the best ask. |

| Delivery/Expiration | No Delivery / Expiration |

| Fees | Check this page for Deribit fees. |

| Position Limit | Maximum allowed position is 1,000,000 contracts (USD 10,000,000). Portfolio margin users are excluded from this limit and can build up larger positions. On request, the position limit could be raised based on an account evaluation. |

Contract Specifications ETH

| Underlying Asset/Ticker | Deribit ETH Index |

| Contract | 1 USD per Index Point, with contract size USD 1 |

| Trading Hours | 24/7 |

| Minimum Tick Size | 0.05 USD |

| Settlement | Settlements take place every day at 8:00 UTC. Realized and unrealized session profits (profits made between settlements) are always added in real-time to the equity, however, they are only available for withdrawal after the daily settlement. At the settlement, session profits/losses will be booked to the ETH cash balance. |

| Contract Size | 1 USD |

| Initial Margin | The initial margin starts with 2.0% (50x leverage trading) and linearly increases by 1% per 5,000 ETH increase in the position size. Initial margin = 2% + (Position Size in ETH) * 0.0002% |

| Maintenance Margin | The maintenance margin starts with 1% and linearly increases by 1% per 5,000 ETH increase in the position size. |

| Mark Price | The mark price is the price at which the perpetual contract will be valued during the trading hours. This can (temporarily) vary from the actual perpetual market price in order to protect market participants against manipulative trading. Mark Price = Index price + 30 seconds EMA of (Perpetual Fair Price - Index Price) The perpetual fair price is the average of bid and ask price for 1 ETH size order. |

| Delivery/Expiration | No Delivery / Expiration |

| Fees |

Check this page for Deribit fees. |

| Position Limit | Maximum allowed position is 10,000,000 contracts (USD 10,000,000). Portfolio margin users are excluded from this limit and can build up larger positions. On request, the position limit could be raised based on an account evaluation. |

Examples of Initial Margin:

| BTC Position size | Maintenance Margin | Margin in BTC |

| 0 | 1% + 0 = 1% | 0 |

| 25 | 1% + 25/100 * 0.5% = 1.125% | 0.28125 |

| 350 | 1% + 350/100 * 0.5% = 2.75% | 9.625 |

Examples of Maintenance Margin:

| BTC Position size | Maintenance Margin | Margin in BTC |

| 0 | 0.525% | 0 |

| 25 | 0.525% + 25 * 0.005% = 0.65% | 0.1625 |

| 350 | 0.525% + 350 * 0.005% = 2.275% | 7.9625 |

Funding Rate

When the funding rate is positive, long position holders pay funding to the short position holders; when the funding rate is negative, short position holders pay funding to the long position holders. The funding rate is expressed as an 8-hour interest rate, and is calculated at any given time as follows:

Premium Rate

Premium Rate = ((Mark Price - Deribit Index) / Deribit Index) * 100%

Funding Rate

Sequentially, the funding rate is derived from the premium rate by applying a damper.

- If the premium rate is within -0.05% and 0.05% range, the actual funding rate will be reduced to 0.00%.

- If the premium rate is lower than -0.05%, then the actual funding rate will be the premium rate + 0.05%.

- If the premium rate is higher than 0.05%, then the actual funding rate will be the premium rate - 0.05%.

- Additionally, the funding rate is capped at -/+0.5%, expressed as an 8-hour interest rate.

Funding Rate = Maximum (0.05%, Premium Rate) + Minimum (-0.05%, Premium Rate)

Time Fraction

Time Fraction = Funding Rate Time Period / 8 hours

The actual funding payment is calculated by multiplying the funding rate by the position size and the time fraction.

Funding Payment = Funding Rate * Position Size * Time Fraction

| Example 1 | If the mark price is at USD 10,010 and the Deribit index is at USD 10,000, the funding rate and premium rate are calculated as follows: Premium Rate = ((10,010 - 10,000) / 10,000) * 100% = 0.10% Funding Rate = Maximum (0.05%, 0.10%) + Minimum (-0.05%, 0.10%) = 0.10% - 0.05% = 0.05% Lets assume a trader has a long position of USD 10,000 (1 BTC) for 1 minute, and during this minute the mark price remains at USD 10,010 and the Deribit index remains at USD 10,000, in this case the funding calculation for this period is: 8 hours = 480 minutes: Funding Rate = 1/480 * 0.05% = 0.0001041667% Funding Payment = 0.0001041667% * 1 BTC = 0.000001041667 BTC The short position holders receive this amount and the long position holders pay it. |

| Example 2 | If a trader chose to hold the position of the previous example for 8 hours and the mark price and Deribit index remained at USD 10,010 and USD 10,000 for the entire period, then the funding rate would be 0.05%. The funding payment would be paid by the longs and received by the shorts. For 8 hours, it would have been 0.0005 BTC (or USD 5.00). |

| Example 3 | If the mark price is USD 10,010 for 1 minute and then changes to USD 9,990 the minute after that, however, the Index remains at USD 10,000, then the net funding in these 2 minutes for a 1 BTC long position is exactly 0 BTC. After the first minute, the trader would pay 1/480 * 0.05% = 0.0001041667% * 1 BTC = 0.000001041667 BTC, however, the minute after, the trader would receive exactly the same amount. |

| Example 4 | The mark price is USD 10,002, and the Index remains at USD 10,000. In this case, the real-time funding is zero (0.00%) because the mark price is within the 0.05% range from the index price(within USD 9,990 and USD 10,010). This can be checked by using the premium rate and funding rate formulas: Premium Rate = ((10,002 - 10,000) / 10,000) * 100% = 0.02% Funding Rate = Maximum (0.05%, Premium Rate) + Minimum (-0.05%, Premium Rate) = 0.05% - 0.05% = 0.00% |

In reality, the spread of the Deribit BTC Index and the mark price changes continuously, and all changes are taken into account. Therefore, the examples above are extreme simplifications of the actual calculations. The funding paid or received is continuously added to the realized PNL and is moved to or from the cash balance at the daily settlement, at 08:00 UTC.

Fees on Funding

Deribit does not charge any fees on funding. All the funding payments are transferred between the holders of the perpetual contracts. This makes the funding a zero-sum game, where longs receive all funding from shorts, or shorts receive all funding from longs.

Mark Price

It is essential to understand how the mark price is calculated. We start by determining the "Fair Price". The fair price is calculated as the average of the fair impact bid and the fair impact ask.

The fair impact bid is the average price of a 1 BTC market sales order or the best bid price - 0.1%, whichever has a greater value.

The Fair Impact Ask is the average price of a 1 BTC market purchase order or the best ask price + 0.1%, whichever has a lower value.

- Fair Price = (Fair Impact Bid + Fair Impact Ask) / 2

The mark price is derived using both the Deribit Index and the fair price, by adding to the Deribit Index the 30 second exponential moving average (EMA) of the Fair Price - Deribit Index.

- Mark Price = Deribit Index + 30 second EMA (Fair Price - Deribit Index)

Further, the mark price is hard limited by Deribit Index +/- 0.5%, so under no circumstances, the mark price of the future can divert for more than 0.5% from the Deribit Index.

Trading outside of this bandwidth is still allowed.

The 30 second EMA is recalculated every second, so in total, there are 30 time periods in which the measurement of the latest second has a weight of 2 / (30 + 1) = 0.0645 or (6.45%).

Allowed Trading Bandwidth

Two parameters bound the trading range:

Perpetual trades are limited by Deribit Index + 1 minute EMA (Fair Price - Index) +/- 1.5%, and a fixed bandwidth of the Deribit Index of +/- 7.5%.

If market circumstances require so, bandwidth parameters can be adjusted at the sole discretion of Deribit.

Options

Deribit offers European style cash-settled options

European style options are exercised only at expiry and cannot be exercised before. On Deribit, this will happen automatically.Cash settlement means that at expiry, the writer of the options contract will pay any profit due to the holder, rather than transfer any assets.

The options are priced in BTC or ETH. However, the relevant price can also be seen in USD. The price in USD is determined by using the latest futures prices. Additionally, the implied volatility of the option’s price is also displayed on the platform.

A call option is the right to buy 1 BTC at a specific price (the strike price), and a put option is the right to sell 1 BTC at a specific price (the strike price).

|

Example 1 |

A trader buys a call option with a strike price of 10,000 USD for 0.05 BTC. Now he has the right to buy 1 BTC for 10,000 USD. At the expiry, the BTC Index is at 12,500 USD, and the delivery price is 12,500 USD. In this case, the option is settled for 2,500 USD per 1 BTC. At the expiry, the trader’s account is credited with 0.2 BTC (2,500/12,500), and the seller’s account is debited with 0.2 BTC. The initial purchase price was 0.05 BTC; therefore, the trader’s profit is 0.15 BTC. Any call option with an exercise price (strike price) above 12,500 USD will expire worthless. Exercising of in the money options happens automatically at the expiry. The trader cannot exercise the option himself, or exercise it before the expiration. |

|

Example 2 |

A trader buys a put option with a strike price of 10,000 USD for 0.05 BTC. Now he has the right to sell 1 BTC for 10,000 USD. At the expiry, the delivery price is 5,000 USD. This option is settled for 5,000 USD, which is equal to 1 BTC (5,000 USD for 1 BTC). Therefore, the owner of this option is credited with 1 BTC at the expiry. The initial purchase price of the option was 0.05 BTC, therefore, the trader’s total profit is 0.95 BTC. |

|

Example 3 |

A trader sells a put option with a strike price of 10,000 USD for 0.05 BTC. The delivery price at the expiry is 10,001 USD. The option expires worthless. The buyer lost 0.05 BTC, and the seller gained 0.05 BTC. |

|

Example 4 |

A trader sells a call option with a strike price of 10,000 USD for 0.05 BTC. The delivery price at the expiry is 9,999 USD. The call option expires worthless. The buyer lost 0.05 BTC, and the seller gained 0.05 BTC. |

Contract Specifications BTC

|

Underlying Asset/ Ticker |

Deribit BTC Index |

|

Symbol |

The symbol of an options contract consists of Underlying asset-Expiry date-Strike price-Options type (C - call/ P - put). Example: BTC-30MAR2019-10000-C This is a call option (C), with a strike price of 10,000 USD, expiring on March 30, 2019. |

|

Trading Hours |

24/7 |

|

Tick Size |

0.0005 BTC |

|

Strike Price Intervals |

It depends on the BTC price. It can vary between 250 USD and 5,000 USD. |

|

Strike Prices |

In-, at- and out of the money strike prices are initially listed. New series are generally added when the underlying asset trades above the highest or below the lowest strike price available. |

|

Premium Quotation |

When denominated in BTC the minimum tick size is 0.0005 BTC. The equivalent in USD is always shown in the trading table, based on the BTC index price. |

|

Expiration Dates |

Every Friday, at 08:00 UTC. |

|

Exercise Style |

European style with a cash settlement. European style options are exercised at the expiry. This is done automatically and no action from the trader is required. |

|

Settlement Value |

Exercise of an options contract will result in a settlement in BTC immediately after the expiry. The exercise-settlement value is calculated using the average of the Deribit BTC index over the last 30 minutes before the expiry. The settlement amount in USD is equal to the difference between the exercise value and the strike price of the option. The exercise value is the 30 min average of the BTC index as calculated before the expiry. The settlement amount in BTC is calculated by dividing this difference by the exercise value. |

|

Multiplier |

1 The usual underlying number of stock options is 100 shares. On Deribit there is no multiplier. Each contract has only 1 BTC as the underlying asset. |

|

Initial Margin |

The initial margin is calculated as the amount of BTC that will be reserved to open a position. Long call/put: None Short call: Maximum (0.15 - OTM Amount/Underlying Mark Price, 0.1) + Mark Price of the Option Short put : Maximum (Maximum (0.15 - OTM Amount/Underlying Mark Price, 0.1) + Mark Price of the Option, Maintenance Margin) |

|

Maintenance Margin |

The maintenance margin is calculated as the amount of BTC that will be reserved to maintain a position. Long call/put: None Short call: 0.075 + Mark Price of the Option Short put : Maximum (0.075, 0.075 * Mark Price of the Option) + Mark Price of the Option |

|

Mark Price |

Mark price of an options contract is the current value of the option as calculated by the Deribit risk management system. Usually, this is the average of the best bid and best ask price. However, for risk management purposes, there is price bandwidth in place. At any time, Deribit risk management sets hard limits to the minimum and maximum IV allowed. Example: If the hard limit settings were at 60% minimum IV and 90% maximum IV, then an option with a midprice with IV higher than 90% will be mark priced at 90% IV. Any option with a midprice lower than 60% IV would be priced at 60% IV. Note that 60% and 90% are merely example percentages, and real rates vary and are at the discretion of Deribit risk management. |

|

Fees |

Check this page for Deribit fees. |

|

Allowed Trading Bandwidth |

Max Price (Buy order) = Mark Price + 0.04 BTC Min Price (Sell order) = Mark Price - 0.04 BTC |

|

Position Limit |

Currently, no position limits are in effect. Position limits are subject to change. At any moment Deribit could impose position limits. |

|

Minimum Order Size |

0.1 option contract |

|

Block Trade |

Minimum of 25 options contracts |

Contract Specifications ETH

|

Underlying Asset/ Ticker |

Deribit ETHIndex |

|

Symbol |

The symbol of an options contract consists of Underlying asset-Expiry date-Strike price-Options type (C - call/ P - put). Example: ETH-30MAR2019-100-C This is a call option (C), with a strike price of 100 USD, expiring on March 30, 2019. |

|

Trading Hours |

24/7 |

|

Tick Size |

0.0005 ETH |

|

Strike Price Intervals |

It depends on the ETH price. It can vary between 1 USD and 25 USD. |

|

Strike Prices |

In-, at- and out of the money (OTM) strike prices are initially listed. New series are generally added when the underlying asset trades above the highest or below the lowest strike price available. |

|

Premium Quotation |

When denominated in ETH, the minimum tick size is 0.001 ETH. The equivalent in USD is always shown in the trading table, based on the ETH index price. |

|

Expiration Dates |

Every Friday, at 08:00 UTC. |

|

Exercise Style |

European style with a cash settlement. European style options are exercised at the expiry. This is done automatically and no action from the trader is required. |

|

Settlement Value |

Exercise of an options contract will result in a settlement in ETH immediately after the expiry. The exercise-settlement value is calculated using the average of the Deribit ETH index over the last 30 minutes before the expiry. The settlement amount in USD is equal to the difference between the exercise value and the strike price of the option. The exercise value is the 30 min average of the ETH-index as calculated before the expiry. The settlement amount in ETH is calculated by dividing this difference by the exercise value. |

|

Multiplier |

1 The usual underlying number of stock options is 100 shares. On Deribit there is no multiplier. Each contract has only 1 ETH as the underlying asset. |

|

Initial Margin |

The initial margin is calculated as the amount of ETH that will be reserved to open a position. Long call/put: None Short call: Maximum (0.15 - OTM Amount/Underlying Mark Price, 0.1) + Mark Price of the Option Short put: Maximum (Maximum (0.15 - OTM Amount/Underlying Mark Price, 0.1) + Mark Price of the Option, Maintenance Margin) |

|

Maintenance Margin |

The maintenance margin is calculated as the amount of ETH that will be reserved to maintain a position. Long call/put: None Short call: 0.075 + Mark Price of the Option Short put: Maximum (0.075, 0.075 * Mark Price of the Option) + Mark Price of the Option |

|

Mark Price |

Mark price of an options contract is the current value of the option as calculated by the Deribit risk management system. Usually, this is the average of the best bid and ask price, however, for risk management purposes, there is price bandwidth in place. At any time, Deribit risk management sets hard limits to the minimum and maximum implied volatility (IV) allowed. Example: If the hard limit settings were at 60% minimum IV and 90% maximum IV, then an option with a midprice with IV higher than 90% will be mark priced at 90% IV. Any option with a midprice lower than 60% IV would be priced at 60% IV. Note that 60% and 90% are merely example percentages, and real rates vary and are at the discretion of Deribit risk management. |

|

Fees |

Check this page for Deribit fees. |

|

Allowed Trading Bandwidth |

Max Price (Buy order) = Mark Price + 0.04 ETH Min Price (Sell order) = Mark Price - 0.04 ETH |

|

Position Limit |

Currently, no position limits are in effect. Position limits are subject to change. At any moment Deribit could impose position limits. |

|

Minimum Order Size |

1 option contract |

|

Block Trade |

Minimum of 250options contracts |

Order Types

Currently, only the market and limit orders are accepted by the matching engine. Additionally, an order can be a “post-only” order; however, this functionality is not available for advanced order types (explained below).A post-only order will always enter the order book without being instantly matched. If the order were to be matched, our trading engine would adjust the order so that it enters the order book at the next best possible price.

Example:

If a trader places a buy order at 0.0050 BTC, but there is an offer for 0.0045 BTC, the price of the order will be automatically adjusted to 0.0044 BTC, so that it enters the order book as a limit order.

For options trading, the platform supports two additional advanced order types. The order book’s prices are in BTC and the options are priced in BTC. However, it is possible to submit volatility orders and constant USD value orders.

By filling the options order form, the trader can choose to determine the price in 3 ways: in BTC, USD, and Implied Volatility.

When an order is priced in USD or implied volatility, the Deribit engine will continuously update the order to keep the USD value and the Implied Volatility at the fixed value as entered in the order form. IV and USD orders are updated once per 6 seconds.

USD Orders

Fixed USD orders are useful when a trader has decided that he wants to pay X dollars for a certain option. Due to the changing exchange rate, this value is not constant in BTC, however, the order book works only with BTC. To maintain the constant USD value, the order will be continuously monitored and edited by the pricing engine.The Deribit Index is used to determine the BTC price of the option in case there is no corresponding future expiring on the same date. If there is a corresponding future, the mark price of the future will be used. However, the future mark price is limited by bandwidth, which is benchmarked against the index - the value used for USD/IV orders cannot differ more than 10% from the index.

Volatility Orders

Volatility orders are orders, with pre-set constant implied volatility. This type of order makes it possible to market-make options series without additional market maker applications.Automatic hedging with futures is not yet supported, however, is on the roadmap. Blacks option pricing model is used to determine prices. Please note that prices are updated once per second. Fixed USD and Volatility orders are also changed by the pricing engine maximum once every second as it follows the Deribit price index. If there is a corresponding future, the future will be used as an input for calculating IV and USD orders.

Historical Volatility Chart

A chart of the annualized 15-day historical volatility of the Deribit BTC/ETH index is displayed on the platform.Volatility is calculated by recording the value of the index once a day at a fixed time. The (annualized) BTC/ETH volatility is then calculated over a period of 15 days.

Mis-Trade Rules

Due to various reasons, there can be a situation when options are traded at prices caused by an abnormal non-orderly market, with a high chance that one side of the trade has been done unwillingly. In such cases, Deribit might adjust the prices or reverse trades.Price adjustments or reversal of options trades will be done only if the traded price of the options contract was further away than 5% from the theoretical price of the underlying options contract (0.05BTC for BTC options).

Example:

If an option is traded at a price of 0.12 BTC, but its theoretical price is 0.05BTC, the trader can request a price adjustment to 0.10BTC.

If a trader realizes that a trade has been executed at a price regarded as mispriced, he should write an email to the exchange ([email protected]) asking for a price adjustment as soon as possible.

The theoretical price of the option is the mark price, though it is difficult for the exchange to have the mark price exactly matching the theoretical price at all times. Therefore, in case of a disagreement about the theoretical price, this price will be determined by consulting with primary market makers on the platform. If there is any disagreement, Deribit will follow their recommendations as to what was the theoretical value of the option at the moment of the trade.

A request for a price adjustment has to be made within 2 hours after the execution of the trade. If for whatever reason the counterparty has already made a withdrawal of funds, and Deribit is not capable to retrieve enough funds from the counterparty, a price adjustment will only be made for the amount that was retrievable from the counterparty account. The insurance fund is not meant and will not be used for funding mistrades.

Market Making Obligations

The matching engine and risk engine are built from the ground up to be able to absorb a large number of orders in a very short period of time. It is a must for any serious options’ exchange due to a large number of assets. The platform is able to handle thousands of order requests per second with ultra-low latency, via REST, WebSockets, and FIX API.Please note that at this moment we cannot accept any new market makers (other than those with whom we are already communicating and are preparing to connect).

Regarding market maker rules explained below, anybody placing quotes (bid and ask) on the same instrument or any trader having more than 20 options orders in the book via automated trading (via API) can be regarded as a market maker and can be forced to comply with the rules below.

Market Maker Obligations:

1. Market maker (MM) is obliged to show quotes in the market 112 hours per week. Quoting 2- sided markets outside allowed bandwidth outlined below is not allowed at any time.2. Instrument coverage:

A market maker has to quote all expiries, and 90% of all option contracts with the delta between 0.1 and 0.9 in absolute terms.

3. Max allowed bid-ask spread: Under normal conditions default, max allowed bid-ask spread should be a maximum of 0.01, (delta of the option) * 0.04.

Delta of the option = BS delta as calculated by Deribit - Mark price as calculated by Deribit

As an example, monthly ATM calls should not be quoted wider than 0.02, delta 1.0 put should not be quoted wider than 0.04, etc.

Exceptions:

- Maximum spread for longer-term options, expiring in 6+ months, or for options for which no respective future with a liquid market exists on the Deribit platform, can be 1.5 times the default spread.

- Maximum spread for newly introduced series with an expiration date of 1+ month can be 1.5 times the default max spread for the period of 5 days after the introduction of the new expiry.

- Maximum spread for newly introduced series with an expiration date in less than 1 month can be 1.5 times the default max spread for the period of 1 day after the introduction of the new expiry.

- In a fast-moving market, the maximum allowed spread can be double the required spread as for normal conditions.

5. Fast-moving market: 10% move in the past 2 hours.

6. No diming: A party gaining extra capacity for quoting (with more than 20 open orders) is not allowed to consistently alter its orders in reaction to changes in other participants’ orders to improve them by a small amount, as opposed to changing orders based on their own market view.

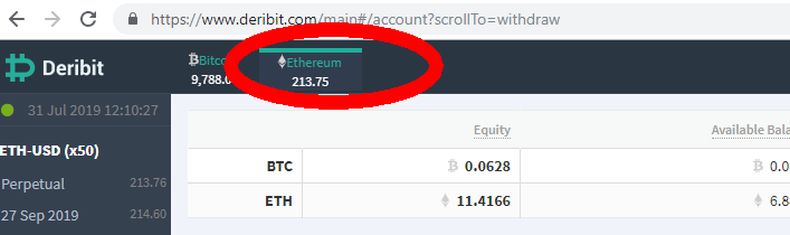

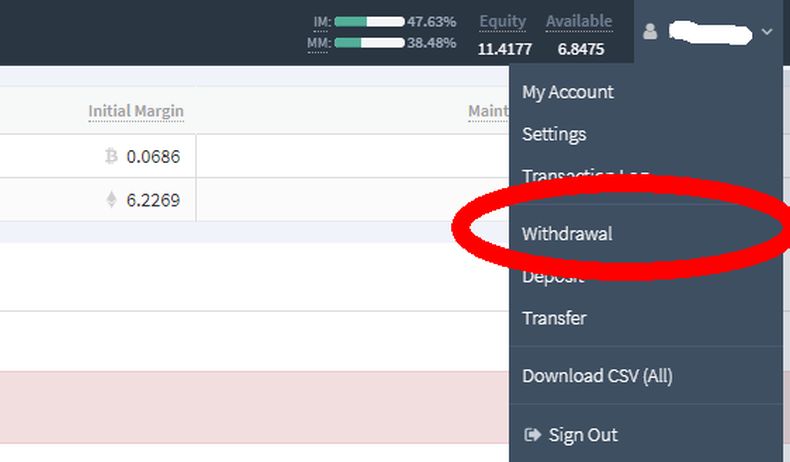

How to Withdraw at Deribit

How To Withdraw Crypto from Deribit

Withdraw Ethereum

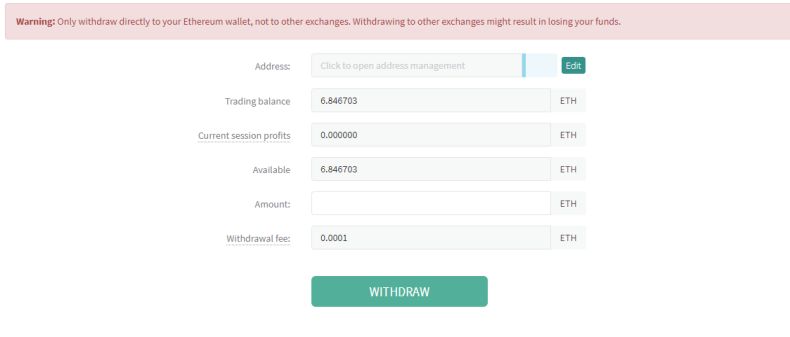

Log in to Deribit.com, make sure you have selected Ethereum tab from the upper navigation menu:

From the menu on the right side, under your username click on Withdrawal

Warning: Only withdraw directly to your Ethereum wallet, not to other exchanges. Withdrawing to other exchanges might result in losing your funds.

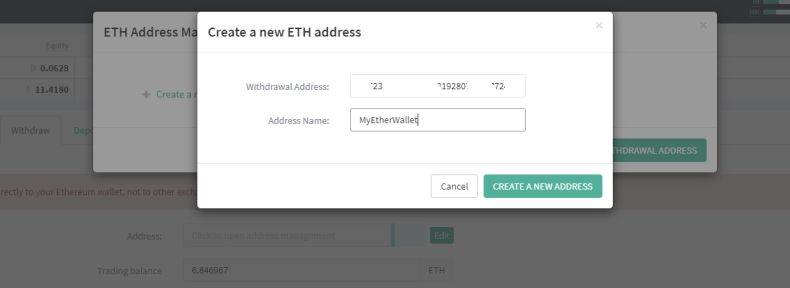

Click on the Edit button to register new ETH withdrawal address, a popup window will appear, click on Create a new ETH address

Enter your Withdrawal Address, I will use ETH wallet at MyEtherWallet. in the field Address Name I will name in MyEtherWallet

Click on the Create a new address button

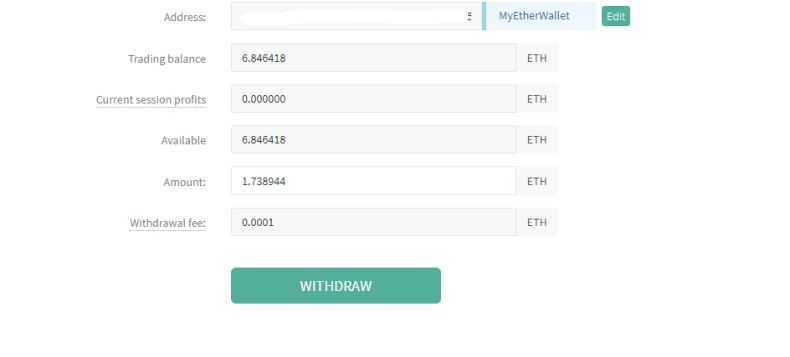

Close the popup window and now you are good to go - transfer ETH out from Deribit

Enter the amount of ETH you want to withdraw and click on the Withdraw button

Now is the good time check your email inbox for Link for withdrawal confirmation from Deribit

Confirm from email.

It took less than a minute for funds to arrive at MyEtherWallet.com

Withdraw Bitcoin

The steps for withdrawing Bitcoin from Deribit platform are the same as when withdrawing ETH. Except you should enter your bitcoin address instead of ethereum.

My withdrawal is pending. Can you speed it up?

Lately the Bitcoin network is very busy and many transactions are waiting in the mempool to be processed by the miners. We cant influence the Bitcoin network and thus we cannot speed up transactions. Also we cannot "double spend" withdrawals to be processed with more withdrawal fee. If you want your transaction to be accelerated, please try the BTC.com transaction accelerator.